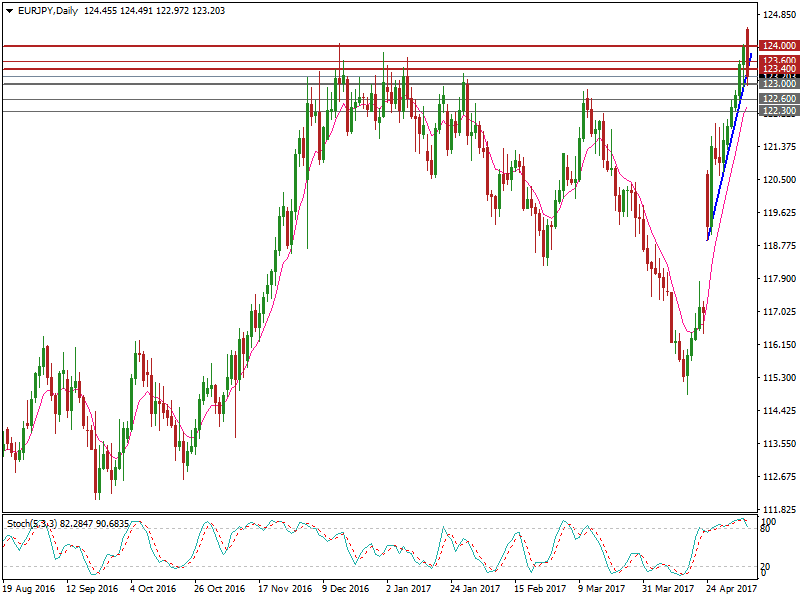

EUR/JPY Falls Below Uptrend Line

During the early Monday Asian session, EUR/JPY hit a high of 124.49, last seen on May 12 of 2016, helped by Macron’s victory in the French presidential election. However, it saw a subsequent retracement, due to profit-taking, falling back below the psychological level at 124.00. On the 4-hourly chart, EUR/JPY broke through the near-term major…

Read more