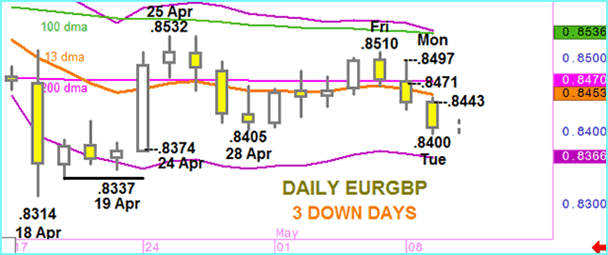

EURGBP reveals negative break of averages

BackgroundYesterday's bearish bias was confirmed as EURBGP moved deeper below the 13 Day Moving Average, with selling pressure steady throughout the day. With immediate studies being negative we are expecting any bounce to be temporary and for the downside to develop.Management and risk descriptionA move through 0.8393 means the stop can be lowered to break…

Read more