LeapRate Exclusive… LeapRate has learned via regulatory filings that FCA regulated retail forex and CFD broker Infinox Capital Limited has reported significant growth in its business for its Fiscal year ended March 31, 2016.

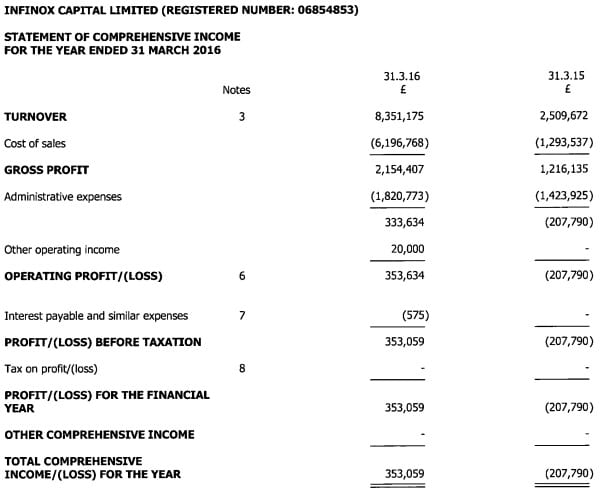

Infinox, which runs MT4, saw Revenues more than triple during the year to £8.4 million (USD $10.4 million), versus £2.5 million in 2015. The company turned a modest profit of £353,000 in 2016, as compared to a loss of £208,000 last year.

The results all occurred when Infinox was still know as Go Markets UK. Go Markets UK rebranded to Infinox Capital in July 2016.

Robert Berkeley, Infinox

Go Markets is better known as an Australia based, ASIC regulated retail forex broker. The separately owned Go Markets UK, controlled by London based entrepreneur Robert Berkeley, formed a strategic partnership with Go Markets Australia to leverage off the Australia company’s brand and technology. Berkeley’s company, founded in 2009 as Blu-Hill Financial Limited, had earlier signed a similar agreement in 2011 with another Australian FX brokerage, VantageFX. The company switched to leverage off of Go Markets’ brand in early 2015.

Infinox CEO Robert Berkeley provided the following statement to LeapRate:

INFINOX has built an enviable reputation in the marketplace since its incorporation in 2009, delivering the ultimate trading experience for MT4 traders globally. We are an FCA regulated business based in the heart of the City of London. The success of the business has been based on our philosophy of delivering a premium customer service. As part of this we provide dedicated account managers for all our clients and strive to be a partner of choice.

Our intention is to create a unique global FX organization, which capitalises on our years of experience, market reputation and technology advancements.

Personalising and empowering our clients is at the heart of what we do, allowing us to differentiate our business in the marketplace and deliver our one-to-one personalised approach to clients and IBs globally. We aim to be the broker and business partner of choice for FX by delivering innovative new products and the ultimate trading experience to our clients.

Infinox Capital’s income statement for 2016: