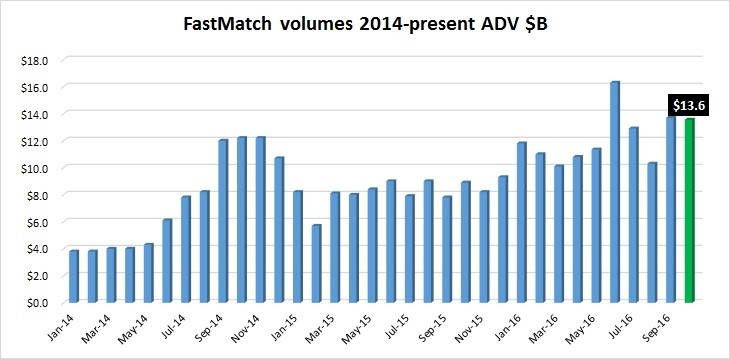

Beginning what we believe will be a series of fairly so-so October trading volume reports by both retail and institutional Forex platforms, Forex ECN FastMatch is reporting that volumes in its system fell marginally by 1% MoM from September, to average $13.6 billion ADV for the month.

That being said, September was FastMatch’s second best month ever for FX trading volumes, second only to June 2016’s $16.3 billion. During most of last year, FastMatch was doing in the neighborhood of $7-9 billion ADV, so it appears that the company has indeed taken a major step up during 2016.

During October, FastMatch hired GFT veteran Gareth Thomas as Director of Sales.

FastMatch is jointly owned by retail forex broker FXCM Inc (NASDAQ:FXCM) and commercial banks Credit Suisse Group AG (ADR) (NYSE:CS) and BNY Mellon Corp (NYSE:BK). FXCM has been active monetizing assets to pay down its high interest loan from Leucadia National Corp (NYSE:LUK) – most recently selling its DailyFX research and news site to IG Group Holdings plc (LON:IGG) for $40 million. We believe that FXCM’s stake in FastMatch may be next on the block.