The following article is courtesy of financial service provider AETOS Capital Group.

2018: A Year of Gloom

2018, as it were, was the toughest year for the financial market since the 1970s. As of mid-November, up to 70% of all 70 asset classes, including U.S. equities, U.S. treasury securities, corporate bonds and gold, saw negative investment returns. The world’s major economies seem to have passed the peak of this latest economic boom after the prosperity of 2017. As geopolitical risks mount and signs of economic recession gradually appear, a giant gray rhino is looming.

A More Radical America and a More Chaotic Europe

The year 2018 saw the U.S. under President Donald Trump embarking on a more extreme unilateralism way. After Trump took office, the White House experienced the worst wave of departures in four decades. However, Trump kept silencing the objections by means of massive reshuffling.

Doves have been “forced to resign.” While Hawks have been given key posts, and fought on all fronts to carry out his plans and asked all the countries across the world to pay the price with the “crazy strategy” peculiar to the President. Withdrawal from groups, exits from deals, tariffs on cars and steel, and other policies have sent global trade and economy into chaos.

Interestingly, so far the U.S., which had launched the trade war, seems to have benefited little.

According to a prediction by the IMF, the current account deficit of the U.S. will rise 26.4% year on year in 2019, with annual growth hitting a post-2000 peak. Mr. Trump’s unfulfilled pledge to reduce the trade deficit will continue as the underpinning of his protectionist motives. In other words, trade wars are likely to become “the new normal” in 2019.

The year 2018 was truly eventful for Europe. Left-wing populism continues growing in the debtor countries of Southern Europe. France, under Emmanuel Macron, has been constantly suffering from the pain of reform. Italy has followed a path of development featuring high welfare and high deficit under the leadership of a populist party. Britain is still trapped in the seesaw battle of Brexit.

Meanwhile, in Germany–the anchor of Europe–Angela Merkel, the iron lady of the current era is forced to declare the premature end of her political life amid internal and external problems.

Given the current situation, political turmoil in Europe and the normalization of global trade conflicts will constitute the two major political threats to the global market.

Weak Economic Data

In 2018, growing aversion toward risks had a strong impact on economic indicators of the world’s major economies.

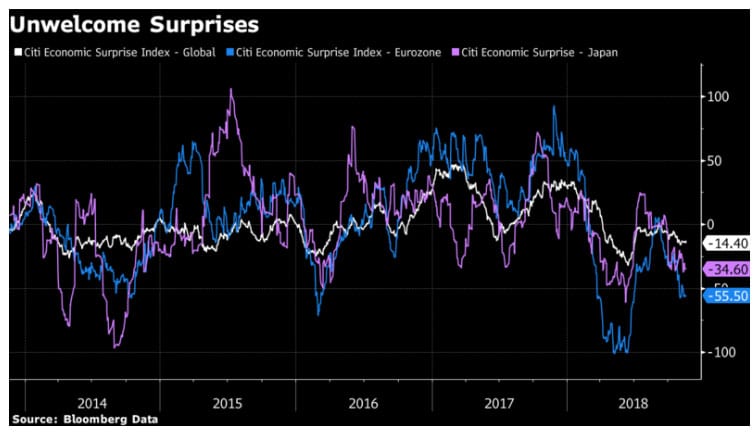

The Citigroup Economic Surprise Index (CESI) curve fully reflects the magnitude and speed of the global downturn. As opposed to the general economic indicators, the CESI indicates the gap between the published value of the economic data of an economy and the median market expectation. The curve above the “0” axis means the economic data readings are generally better than market expectations; and the opposite occurs when it comes below the “0” axis. As can be seen in the figure below, the period from the fourth quarter of 2017 to the first quarter of 2018 represented a turning point, as it was when the economic downturn started. Among the major economies, the Eurozone underwent the most serious downturn.

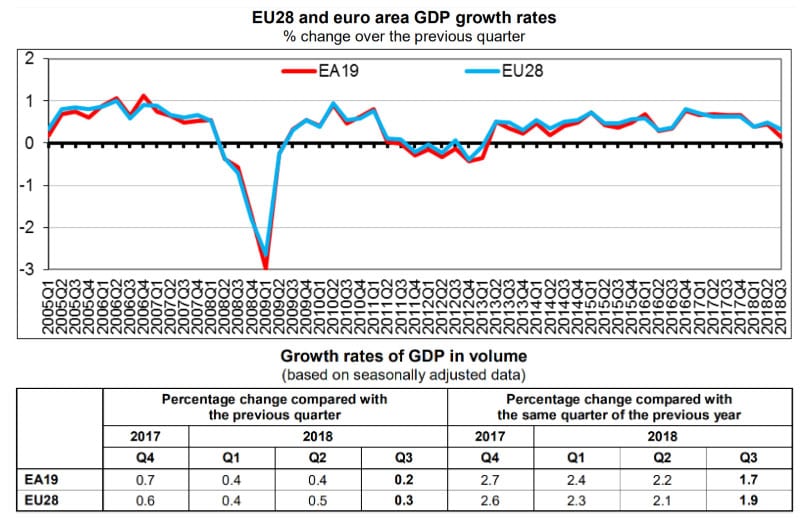

A look at the concrete data shows that, in the third quarter of 2018, the GDPs of 19 countries in the Eurozone saw the lowest quarter-over-quarter growth in almost four years. Year-on-year GDP growth dropped from 2.7% in the fourth quarter of 2017 to 2.4% in the first quarter of 2018, which was followed by a 2.2% in the second quarter and a 1.7% in the third quarter, thus reflecting an obvious drop in economic growth.

Overall, the U.S. economy is more resilient than that of the Eurozone, so its engine of economic growth kept roaring until the end of the second quarter of 2018. Moreover, the real GDP growth of the second quarter was the best in nearly four years. It is safe to conclude that the tax-reform policies introduced by the U.S. government at the end of 2017 had boosted the economy much more strongly than was previously expected. However, as the marginal effect of stimulus policy rapidly diminishes, its contribution to economic growth will continue to drop. Given that the Democratic Party now dominates the House of Representatives and holds the purse strings, Mr. Trump will face stiff resistance to any further possible fiscal stimulus.