This article is written by Usman Ahmed at Investoo Group, which provides expert products for the financial trading industry.

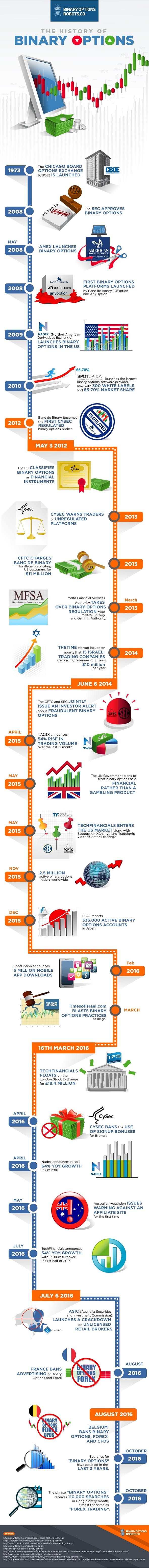

Binary options trading is becoming increasingly famous worldwide after the advent of binary options exchanges such as Nadex and Daweda Exchange. In binary trading you can bet on financial assets and make some quick profits. The history of binary options trading dates back to 1974 when the Chicago Board Options Exchange (CBOE) was officially launched. In 2008, options were publicly made available for the first time as tradable assets on CBOE.

2008 was the year when the subprime mortgage crisis in the United States triggered one of the worst financial meltdowns in human history. Lehman Brothers, Bear Stearns and many other symbols of financial stability collapsed one by one. This was the scenario when investors realized the need for a low-risk investment option which consequently led to the emergence of binary options trading.

In May 2008, binary options were publicly made available as tradable assets on American Stock Exchange (AMEX). A couple of months later, few binary options platforms were introduced by brokers such as 24Option, Banc De Binary and AnyOption. Those brokers are considered pioneer in the binary options industry. The trend of binary options trading touched new highs after the advent of binary brokers, However, the conflict of interest problem emerged as a result of binary options trading via brokers because everyone was betting against the brokers which means brokers were the losers when traders won and vice versa.

The conflict of interest problem led to the emergence of binary options exchanges and in 2009 the first binary options exchange came into being. The name of the exchange was Northern American Derivatives Exchange (NADEX). Binary exchanges allow peer to peer trading of binary options contracts which means a binary trader can bet against another binary trader (instead of the exchange or broker). This concept successfully addressed the conflict of interest problem and consequently binary options trading continued flourishing.

In 2010, SpotOption was launched – the largest binary options software provider which currently holds more than 300 white label brokers and capitalize more than 60% market share. 2012 was also an important year in the history of binary options trading when Banc De Binary announced to become the first ever regulated binary options broker and prompted other binary brokers to follow the same path. In May 2012, Cyprus Security & Exchange Commission (CySec) – the chief regulatory agency of Cyprus- for the first time classified binary options as tradable assets; then began a slightly dark period for the binary options industry when a number of binary options scams attracted the attention of mainstream media. In 2013, CySec warned traders of unregulated binary options platforms amid lots of complaints from binary options traders. Same was the year when Commodity Futures Trading Commission (CFTC) fined Banc De Binary for illegally soliciting US customers for almost $11m. In June 2014, the CFTC and SEC issued a joint investor alert, warning binary options traders about fraudulent platforms.

In April 2015, Nadex announced 54% rise in trading volume during a 12-month period. One month later, the UK government announced plan to treat binary options as a financial product (and not the gambling product). In February 2016, SpotOption announced a record 5 million mobile app downloads. In October 2016, the term “binary options” recorded 110,000 monthly search on Google – almost the same as Forex trading.