LeapRate Exclusive Interview… LeapRate reported exclusively last month that trading platform provider TradeSmarter has spun off a new RegTech company called Backpack. Based in Singapore, Backpack (www.backpack.io) provides turnkey back office solutions for brokers.

Since posting, we’ve had a lot of queries from LeapRate readers about RegTech, and why it is becoming an important issue for brokers to address. So we went to the source to speak with Yoni Avital, founder of Backpack and CEO of TradeSmarter. Here is what he had to say.

LR: Hi Yoni, and thanks for joining us today. Please let us know a little more as to what RegTech really is, and where it applies.

Yoni Avital, CEO of Backpack.io

Yoni: RegTech is subset of FinTech that has only recently started to gain traction. RegTech leverages technologies such as cloud computing and big data to enable financial firms to save time and resources they invest in order to ensure regulatory compliance.

Global financial regulatory requirements are in place to protect customers and businesses, but they also often hinder the ability of a business to operate effectively. In turn, there is great potential in this niche to enable businesses to be more efficient while meeting all regulation requirements. At Backpack.io we are translating these regulatory requirements into technologies that allow for automated processes to enable businesses to operate more efficiently.

Take for example mobile compliance. In this space, online marketers seek high conversion rates and a good user experience whereas regulators require comprehensive information through KYC procedure, regulation paperwork and questionnaires. Backpack.io resolves this inherited conflict between online marketers and regulators using a mobile (any device) online ID verification and questionnaire technology that is increasing conversion rates while fully adhering to the regulator’s requirements.

LR: Why should RegTech be important to people running Forex or Binary Options brokerages?

Yoni: Regulatory compliance is one of the most time and resource-consuming aspects at financial firms, which only became increasingly so after the regulations imposed post-financial crisis. With MiFID II coming in 2018, authorities will significantly increase the information requirements from financial institutions.

In this situation, RegTech solutions provide two important advantages for financial firms. First, they provide important cost and efforts savings. Secondly, the enable firms the option to report much more accurate information to supervisory authorities. Additionally, RegTech options offer an increased level of information accuracy and availability to financial firms, which makes it easier for financial entities to monitor their systemic risk.

Overall, RegTech will contribute to developing a more transparent and controlled global financial system, eliminating the deficiencies that may cause a financial crisis.

LR: How do you see the regulatory climate changing in the coming months for the online trading sector?

Yoni: The extended definition of financial products and reporting obligation under MiFID II will have an especially significant impact on firms that automate and produce a large amount of data to be delivered to designated repositories. There will be more appropriateness and suitability checks required, including competence and knowledge requirements for staff providing financial advice; this will also need to be performed individually and at the end client level.

Many in the financial sector are worried about the ramifications that these regulations will have on businesses. From my point of view, though, there is a great opportunity for an impactful disruptive technology which will resolve this newly forming pain point and complexity in the space.

LR: You’ve decided to base Backpack.io in Singapore. Why Singapore?

Yoni: Many believe that New York remains the financial capital of the West, with the US banks that had tottered on the brink of collapse having returned their previous stature. Europe, in my opinion, has signaled that it is still struggling with many Italian and Greek banks lurching from crisis to crisis and, more recently, Deutsche Bank appearing to be undergoing severe financial distress. London is in better shape than it was in 2008, but the Brexit referendum may lead to a long term de-rating of the City as a premier financial center.

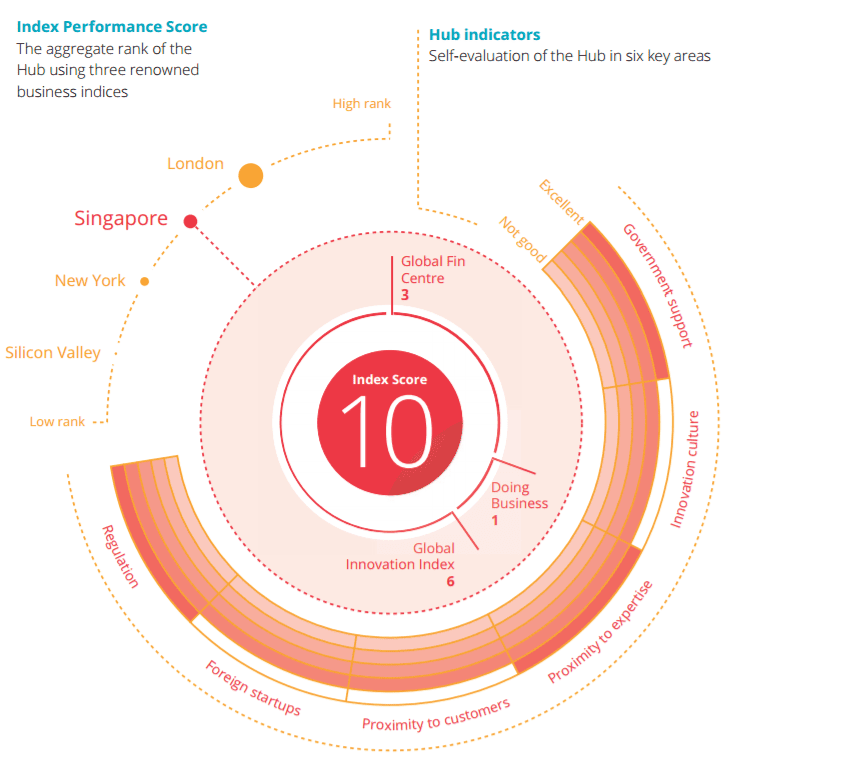

Having established numerous companies over the years with a reputation of transparency and openness, I found Singapore to have the most supportive regulatory framework and laws that result in an accommodating environment for new FinTech start-ups. The FinTech regulator Monetary Authority of Singapore also encourages innovation while also keeping the market protected. In the recent Deloitte Southeast Asia Financial Services Newsletter Issue 13, November 2016 the Singapore financial hub profile received a perfect 10 points and described as “Singapore is a leading international financial centre and a serious contender for the global number one spot in FinTech“. (see also detailed graph below). On top of that, the latest polls show that Singapore has overtaken Hong Kong as Asia’s top financial hub.