Why is the Euro suddenly weak?

John Hardy, Head of FX Strategy at Saxo Bank explains. More of John’s research can be seen at Saxo Bank’s TradingFloor.com.

- Latest polls show French presidential hopeful Marine Le Pen even further ahead

- EURUSD and EURGBP’s downward trend spurred on by polls

- But Trump and Brexit have shown us polls are not always to be believed

- FOMC minutes this evening unlikely to provide much in the way of takeaways

- Aussie strong but against a backdrop of what we see as looming credit disaster

John Hardy, Saxo Bank

The latest French presidential election polling continues to see Le Pen’s percentages rather elevated and the Germany to France bond spreads staying that way as well, with the 10-year sovereign spread still near eighty basis points. This continues to pressure the euro across the board and this pressure could continue at least until we get the results of the April vote – we have all been well trained to not believe the polls over the last year of Brexit and Trump’s win.

The most technically notable development among the major euro pairs was the breakdown of EURGBP support as noted below. EURJPY is also on the defensive, EURAUD is near multi-year lows, and EURUSD has poked toward the locally important 1.0500-25 zone which is the last real bastion of support ahead of the cycle lows below 1.0350.

The lack of USD conviction outside of EURUSD here likely stems from the desire to wait and see what president Trump will deliver in his speech before a joint session of Congress next Tuesday. As well, yesterday’s flash PMIs from the Markit survey were uninspiring and weak relative to January.

Tonight, we have the Federal Open Market Committee minutes, though it is hard to believe in the potential for any takeaways from these as Federal Reserve chair Janet Yellen’s testimony before Congress was more recent and we see the Fed as reactive to data and Trump policy and generally unable to provide forward guidance beyond shifting the odds for a given meeting.

The Australian dollar remains one of the strongest currencies, and Reserve Bank of Australia governor Philip Lowe remains very optimistic sounding in his latest rhetoric, with the latest comments overnight trying to put a positive spin on the employment situation. But the backdrop to us looks like a credit disaster in the making over the longer term. Although, the currency is doing its best to look invulnerable on global reflationary hopes at the moment – so no hooks at all here on the charts just yet for expressing a negative view as we have to respect the market’s view for now.

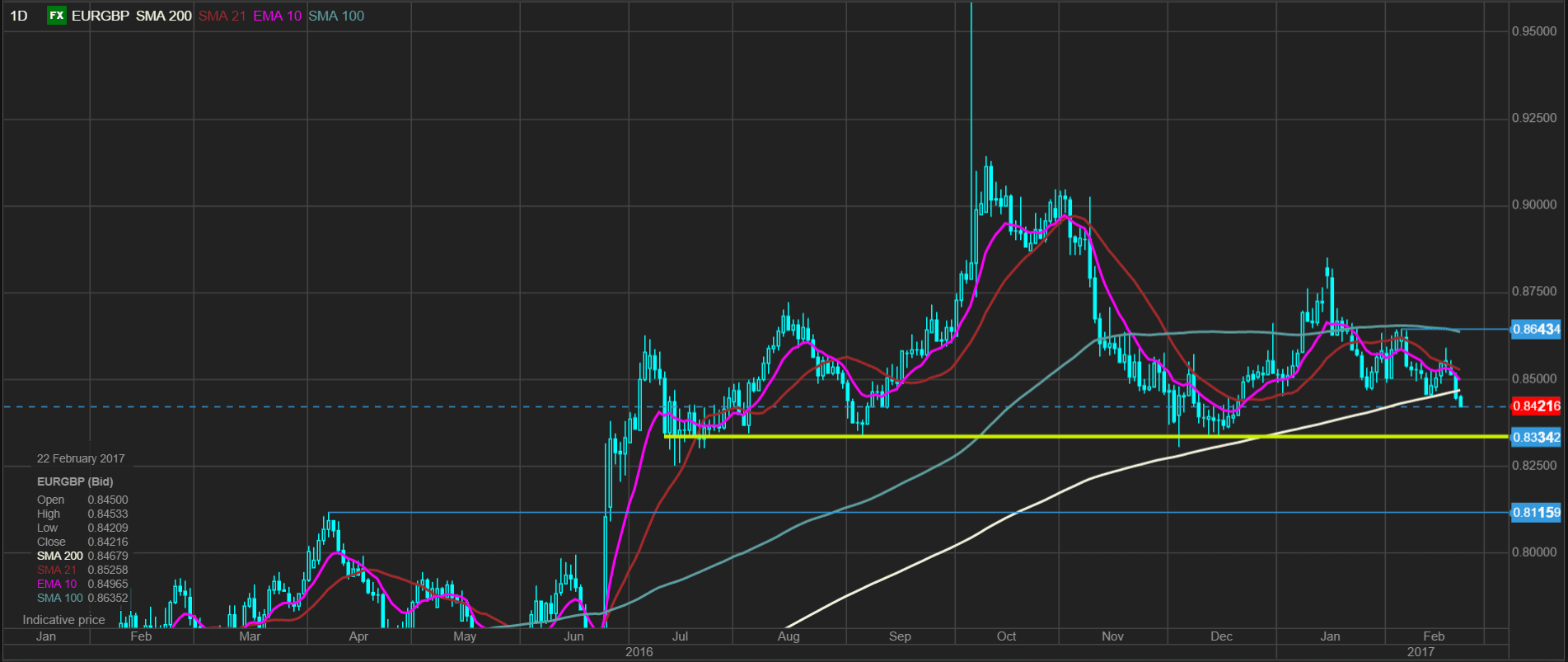

Chart: EURGBP

EURGBP pushed back lower after giving the impression of a false break previously in the same sub 0.8470 area. This time, the break looks of higher quality with a broadly weaker euro and with support for sterling from a less dovish Bank of England governor Mark Carney yesterday, as UK rates got a minor boost. The next big level is the large post-Brexit head and shoulders with a neckline in the 0.8350-00 zone, which could open up for significantly lower levels.

Source: Saxo Bank

The G-10 rundown

USD – the greenback biding its time outside of EURUSD, likely waiting policy signals from president Trump next Tuesday. The latest upgrade in Federal Reserve expectations offering some support, however, and the currency could follow through a bit higher once the FOMC minutes are out of the way tonight.

EUR – broadly weaker as the single currency is dogged by political uncertainty, something that is likely to at least hold the currency back until the first round of the French presidential elections in late April. Watching sovereign spreads as well.

JPY – the JPY looks firm against the suffering euro, but is in the middle of the middle of the recent USDJPY range. No strong signals are likely until we get a more notable move up or down in bond yields with JPY likely in negative correlation – especially after Trump’s speech next Tuesday.

GBP – sterling is rallying strong against a weak euro – and even firm against the dollar, so it is a bit about sterling as well. Really key levels approaching toward 0.8350 in EURGBP if we continue lower as noted above.

CHF – the franc likely under significant pressure to appreciate on the weak euro theme, but the Swiss National Bank is doing what it can to resist the onslaught.

AUD – hats off to the RBA for sounding positive, but there is a good reason Lowe doesn’t want to cut. It has less to do with strength in the Australian economy and more to with not wanting to make Australia’s housing credit bubble any bigger.

CAD – 200-day moving average in USDCAD more or less holding back as latest oil surge sees a bit of CAD buying interest. We like USDCAD higher, but it has been a tough slog.

NZD – kiwi remains weak, with AUDNZD poised near the key 1.0750 area and NZDUSD at recent supports – capitulation risk?

SEK – Riksbank doing its level best yesterday to talk down the currency with some success, as EURSEK has stayed rangebound while the euro is weaker elsewhere.

NOK – the excitement here is on oil prices and this could drive a bit more NOK strength, though we don’t have great expectations for anything beyond loose correlation with oil.