Bats Europe, a CBOE Holdings, Inc. (NASDAQ: CBOE) company and the region’s largest equities exchange operator, and BIDS Trading, L.P. announced today the successful buy-side focused launch of Bats LIS (Large in Scale), a new block trading service for the European equity market, on Friday, 17 March 2017.

The platform, which rolled out to sell-side participants late last year also reported record volume of €36.5 million on 16 March and record weekly volume of €114.8 million for the week ending 17 March.

Bats LIS is a large in scale indication of interest (IOI) negotiation and execution platform that allows market participants to negotiate large blocks in European equities without revealing their intentions to the wider market. Bats LIS leverages BIDS’ highly-regarded software, BIDS Trader, and buy-side channel distribution, combined with Bats’ infrastructure for trade execution, clearing and settlement.

Buy-side firms now have access to Bats LIS via the BIDS Trader system that integrates with buy-side Order Management Systems (OMS) and Execution Management Systems (EMS). Buy-side traders utilising Bats LIS can do so in a manner in which they are accustomed to through their existing BIDS Trader GUI.

Currently a dozen sell-side firms are connected to Bats LIS. Bats expects the number of firms using Bats LIS to continue to grow given the interest in the service.

Mark Hemsley, Bats

Mark Hemsley, CEO of Bats Europe, said:

We’ve brought together the complementary strengths of Bats Europe and BIDS to create a much-needed solution to the challenges of trading large blocks of stock in the European market.

Designed to meet the unique needs of the buy-side, Bats LIS provides buy-side firms with control over their IOIs up until execution, which helps to protect against information leakage, while maintaining their important relationships with their brokers. Additionally, Bats LIS is unique in that it brings together the block flow of both the buy-side and sell-side, which allows for greater crossing opportunities.

Tim Mahoney, CEO of BIDS, commented:

Global clients want global solutions. BIDS has grown to be the largest block trading platform by volume in the U.S. by maintaining the client broker relationship and opening the pool to both buy and sell-side flow. The partnership with Bats allows BIDS to seamlessly extend those strengths into the European market to better serve our user community.

The service provides buy-side traders with protection against information leakage through several unique features. First, IOI disclosure and interaction is controlled by the buy-side dealer via customisable trading tools, including minimum block size and counterparty scorecarding and filtering based on past trading behaviour. Secondly, designated broker selection occurs when the IOI negotiation has been completed and the broker executes the order on exchange.

The Bats LIS workflows have been specifically designed so that the negotiated price cannot be changed by and subsequent process and also the negotiated IOI cannot be broken up by other orders when it reaches the Bats Recognised Investment Exchange (RIE) for execution.

Bats LIS is a MiFID II compliant platform. Under MiFID II, which is scheduled to come into effect on 3 January 2018, Large in Scale trading will benefit from one of the waivers enabling market participants to negotiate trades without the need for pre-trade transparency, thus protecting firms wishing to conduct business in large blocks from unfavourable market movements based on information made available in the market.

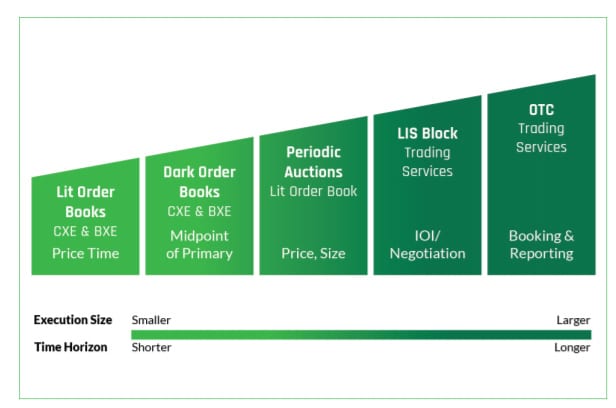

Bats LIS further enhances Bats Europe’s suite of trading services providing trading participants with various options to execute their trading strategies in a way that best suits them. Following is an overview of the trading services offered and the type of trading activity that takes place on each of these platforms:

All securities admitted to trading on Bats Europe are available for trading on Bats LIS, representing 5,500 securities across 15 major European markets.