London Stock Exchange Group Plc (LSEG) said its $13 billion tie-up with Deutsche Boerse AG is unlikely to proceed after a new regulatory hurdle signaled a potential end to the companies’ efforts to create a champion European exchange, according to Bloomberg.

European Union officials had requested that LSE divest MTS, an electronic trading platform for European government bonds. LSE said it couldn’t commit to such a divestment and would not submit a remedy proposal.

LSE spokes-person commented:

Based on the commission’s current position, LSEG believes that the commission is unlikely to provide clearance for the merger.

The deal emerged a year ago, months before the U.K.’s Brexit vote, when approval in Brussels was seen as the biggest hurdle. Britain’s decision to leave the EU has complicated matters, with German officials steadily voicing opposition to the plan to base the holding company in London, and U.K. lawmakers complaining the tie-up would weaken its negotiating position. Traders had put odds of the deal completing at less than 50 percent.

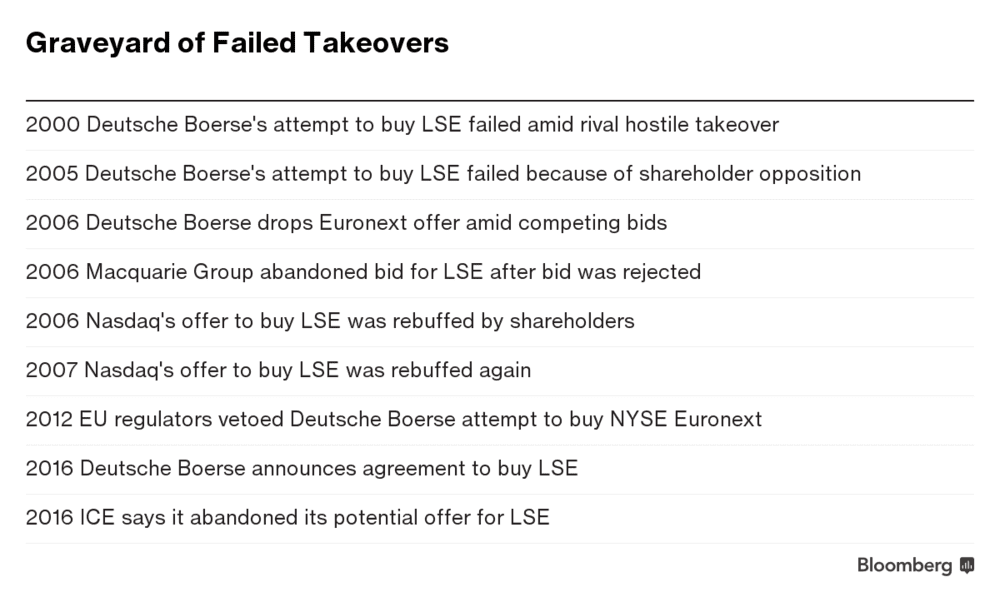

It’s not the first time that Deutsche Boerse has tried to buy LSE, a market operator with roots going back more than 300 years.

Image source: Bloomberg

Their ambition is to create Europe’s dominant operator in everything from indexes to stock markets and clearing, with businesses in more than 30 countries. It would potentially be the most profitable company in its industry. Some have said it could create a bridge between financial centers London and Frankfurt, at a time when politics threaten to pull them apart.

Previously, the only offer to appease antitrust regulators had been LSE’s proposed sale of its French clearinghouse. LSE said the commission unexpectedly brought up new concerns about its planned sale of the French unit and its relationship to MTS. LSE and Deutsche Boerse provided a remedy to EU officials, which was rejected. Instead, the commission sought the divestment of LSE’s majority stake in MTS to win clearance for its deal with Deutsche Boerse, LSE said.

Despite the setback, LSE says the transaction isn’t quite dead.

The LSEG board remains convinced of the strategic benefits of the merger and recognizes the strong support from shareholders for the transaction,” a spokes-person of the company said. “LSEG will continue to take steps to seek to implement the merger.

Regulators are due to rule on the takeover by April 3, but Deutsche Boerse said in a statement Sunday that it expects a decision by the end of March. The German state Hesse, a vocal critic of the deal, regulates Deutsche Boerse and will review the deal if it survives EU scrutiny.

LSE has argued that the combination with the German company made even more sense since Brexit. While the looming fracture will place London, the region’s financial hub, outside the bloc, a combined London-Frankfurt exchange company could help reinforce Europe’s financial stature.

Deutsche Boerse Chief Executive Officer Carsten Kengeter, has argued the deal would help drive the European economy. And without a major acquisition, he said, the exchange risks being overshadowed by heavyweights in the Asia and the U.S. Kengeter is in line to run the merged company.