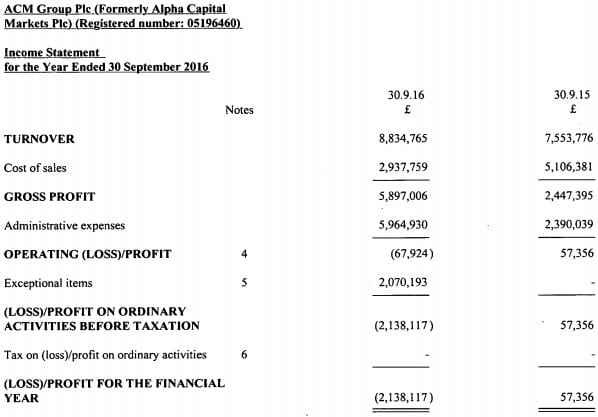

LeapRate Exclusive… LeapRate has learned via regulatory filings in the UK that FCA regulated institutional FX brokerage ACM Group plc, which operates under the brand name Alpha Capital Markets, has posted a loss of £2.1 million (USD $2.6 million) in fiscal 2016. Alpha has a September 30 fiscal year end.

Muhammad Rasoul, Alpha Capital Markets

The news was not all bad, as the company did increase revenues by 17% over 2015, £8.8 million versus £7.6 million last year. However Alpha went through an internal restructuring during 2016, with ownership (UAE/British businessman Tony Afram) bringing in new senior management led by CEO Muhammad Rasoul, who joined the company from Gain Capital Holdings Inc (NYSE:GCAP) where he was EVP and Chief Product Officer. Mr. Rasoul brought along with him some of his former team from Gain Capital, who have been together for years doing mostly institutional FX brokerage and services from their time together at GFT, which was acquired by Gain in 2013.

Not surprisingly given their backgrounds, the new management team have taken Alpha on a more institutional bent. The company made the decision to move away from marketing directly to retail clients, and focus solely on offering solutions to institutional FX traders and directly to retail FX brokerages. Along those lines, we recently reported that Alpha joined forces with MT4 technology provider Gold-i to offer MT4 / MT5 multi asset bridge and liquidity.

The company has continued to deal with retail clients, via introducing brokers (IBs). But overall, in order to focus on institutional FX and gaining liquidity and other business from Retail Forex brokers, the company decided to not compete directly with their customers.

The changeover to institutional, including the development of a new trading platform with an increased range of products, led to much higher costs in 2016, leading to the £2.1 million loss (versus a modest profit of £57,000 in 2015) despite higher revenues.

The ownership group didn’t inject any new capital into Alpha during the year, meaning that the company’s capital base shrunk in 2016, sitting at £2.7 million at year end, down from £4.8 million in 2015.

Alpha held £9.6 million in corporate client funds at year end, nicely up from £2.3 million in 2015.

Will the company’s investment and restructuring to institutional FX pay dividends down the road?

ACM Group plc’s 2016 income statement follows: