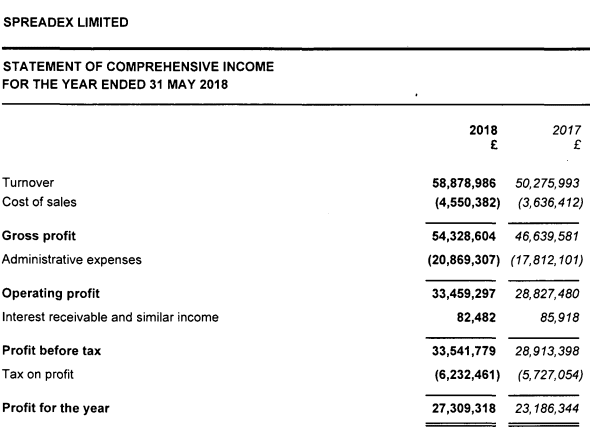

LeapRate Exclusive… LeapRate has learned via regulatory filings that FCA regulated financial and sports spread betting company Spreadex saw significant top line Revenue growth of 17% in its latest Fiscal year ended May 31, 2018. That, following a 2017 year where Revenues were flat.

On the bottom line Net Profit for 2018 was £27.3 million, up 18% from was £23.2 million in 2017.

Jonathan Hufford, Spreadex

Spreadex was founded in 1999 by former City dealer Jonathan Hufford, who remains the company’s CEO, and has grown both organically and via a number of acquisitions. In May 2006 Spreadex launched an online sports spread betting service and followed that by launching a financial spread betting online trading platform soon after.

In June 2011 Spreadex acquired the client database of extrabet, the sports betting arm of IG Group Holdings plc (LON:IGG), doubling the size of its sports business and leading to an estimated 35% share of the sports spread betting market. In January of 2012 Spreadex acquired the client database of MF Global Spreads and in February 2012 the client database of ShortsandLongs.com was incorporated into Spreadex, giving the firm an estimated 10% share of the financial spread betting market. In March 2013 Spreadex purchased the non-equities business of rival spread betting firm Cantor Index. Spreadex had attempted to acquire rival LCG in 2014, but its £0.30 per share all cash bid was rejected.

Spreadex stated that one of its key challenges during 2017-18 was preparing for the new ESMA rules limiting leverage and requiring negative balance protection. More-so than at many other brokers, as Spreadex operates both financial trading and sports betting businesses the preparation for ESMA was somewhat more complicated and involved. The company indicated that retail clients used to hold credit accounts for both sports and financial spread betting. But with sports betting sitting outside the scope of MiFID, the company had to act to separate the sports and financial products for retail clients.

Regarding the ESMA rules, Spreadex stated that it opted up about half of its financial clients (represented by percent of revenues generated) to ‘Professional trader’ such that this group should not at all be affected by the new ESMA rules.

Spreadex paid out a very nice dividend of £22.0 million to shareholders during the year, representing most of its £27.3 million profit.

Spreadex’s 2018 income statement appears as follows: