It looks like social trading isn’t quite dead yet.

LeapRate has learned via regulatory filings that FCA licensed Ayondo Markets has continued to grow its social trading focused brokerage, although with losses continuing to mount.

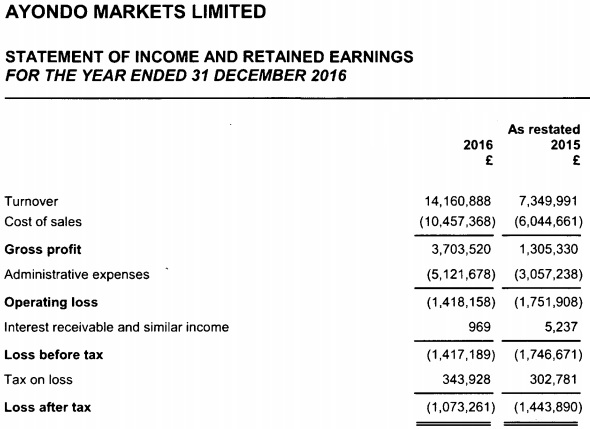

Ayondo reported that its UK unit, Ayondo Markets Limited, grew its Revenues from £7.3 million in 2015 to £14.2 million in 2016 (USD $18.5 million) – an increase of 95%. However the growth came at a cost, with Ayondo posting a £1.1 million loss for the year. in 2015 Ayondo lost £1.4 million.

Ayondo stated in its filing that it actually turned a profit in the first nine months of the year, such that in Q4 (Oct-Dec 2016) alone it must have lost at least £1.1 million.

The company also significantly grew its Client Assets to £26.7 million as at 31/12/16, up from £14.2 million the previous year.

As was exclusively reported by LeapRate, Ayondo Markets raised £2.7 million during the year from its controlling shareholders, to help cover the continued losses and to provide additional regulatory capital as client assets continued to grow. Ayondo shareholders have put £13.9 million in capital into the company, with accumulated losses totaling £11.9 million to date. The shareholders have also put another £850,000 into the company during 2017.

The wider Ayondo Group acquired Singapore based investor education app TradeHero in Q4, and deployed resources to monetize the TradeHero brand through the development of a stripped down and simplified mobile trading app, TradeHero Live. Ayondo plans to use the TradeHero brand to further diversify its offering geographically – mainly in Asia – and by targeting a client universe that is intrinsically different from those clients onboarded via Ayondo’s existing products. Ayondo also signed an agreement with TradeHero China to target Chinese traders with a more simplified, casual trading product.

Ayondo has focused its marketing efforts on video, advertising on the Bloomberg TV channel as well as with targeted YouTube campaigns.

Robert Lempka, Ayondo

Ayondo is headed by co-founders Thomas Winkler (Chairman) and Robert Lempka (CEO). Both act as directors in the UK entity.

Ayondo also gave a “non-update update” on its plans to go public on the Singapore stock exchange via a Reverse Takeover, which the company first let be known more than 18 months ago. All that was stated was that it is “due to complete in 2017”.

Ayondo Markets is a unit of Ayondo Holdings AG, a Swiss based company.

Ayondo Markets’ 2016 income statement follows: