Retail Forex, CFDs and Spread Betting broker London Capital Group Holdings plc (LON:LCG) has released its results for the first six months of 2017, indicating that the company is indeed well along in its restructuring and turnaround, but still has a long way to go.

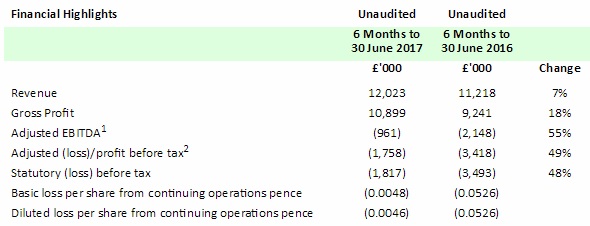

On the top line, LCG was able to generate healthy revenue growth following its rebranding and the release of its new platform in 2016. First half 2017 revenues came in at £12.0 million, up 7% from 1H 2016 and fairly steady as compared to the second half of last year.

But the major improvement in LCG’s financials came at the bottom line, with the company cutting significantly both its EBITDA and Net Loss as compared to last year. LCG lost £1.8 million in the first half of the year, down from £3.5 million in last year’s first half and £4.2 million in the second half of 2016, putting the company much closer on the road to profitability.

LCG reported that client trading volumes were up 25% from the second half of last year, totaling £127 billion (or about USD $28 billion per month).

Client net deposits were up 71%, averaging £2.4 million a month versus £1.4 million in the second half of last year. The number of new funded clients was up 9%, 2,662 versus 2,437 last year. Assets under management were up 17% to £17.3 million, from £14.8 million at the end of 2016.

Charles-Henri Sabet, LCG

Commenting on the results, Charles-Henri Sabet, LCG Group Chief Executive, said:

The results are extremely encouraging and continue to demonstrate how LCG’s performance is improving following its investment in technology, product offering and branding. This improvement has been achieved against the background of challenging trading conditions in the first half of 2017. During this period, the Group has seen strong revenue growth primarily due to increased client acquisition and participation as well as revenue capture compared to prior periods. This has enabled LCG to grow despite the lack of volatility in the market resulting in a benign trading environment.

LCG’s ability to capture and take advantage of trading opportunities means that the Group is now better positioned to be resilient during periods when trading conditions are weak and we remain fully focused on our goal of returning LCG to profitability.

The outlook for the industry continues to remain uncertain given the changing regulatory landscape. This is anticipated to have an impact on the industry and affect the services that can be offered to clients, particularly with regard to the levels of leverage that can be offered. However, the precise impact of this will not be known until the regulatory authorities have finalised their conclusions. LCG remains committed to ensuring the highest standards of regulatory compliance and welcomes changes that will improve and protect client outcomes.

As far as outlook goes, LCG stated that the financial year has started well and with actions already taken to manage costs and to drive further investment for future growth, the Board and management “remain confident about the prospects for the business in the coming periods and are fully committed to ensuring that LCG continues on the path to sustained long-term growth”.

The full LCG 1H results announcement can be seen here. The company’s official CEO statement follows:

UK CHIEF EXECUTIVE OFFICER’S STATEMENT

For the period ended 30 June 2017

Financial Results

Following investment made by the Group in prior periods to improve its technology, product and people, as well as expand its offering from both a product and geographical perspective, the Group has experienced a positive start to the trading year. This is despite the difficult trading conditions seen in the first half of the year when volatility has remained at historical lows with the CVIX (Chicago Board Options Exchange Market Volatility Index, which is a measure of the implied volatility of the S&P 500) gauging at historically low levels. This resulted in benign trading conditions as markets across the majority of asset classes traded within their ranges.

Despite such challenging trading conditions, the Group has seen improvements across a number of key operating metrics with trading volumes up significantly at 25% compared with the previous period, demonstrating that LCG is now attracting significantly higher quality clients with a greater propensity to trade a greater number of asset classes.

A key objective for LCG in the second half of 2016 was to improve the trading platform and increase its product offering to provide clients with greater choice. Successful work in this area has led to a significant increase in clients now trading LCG’s new and enhanced FX offering with volumes in this product up 66% compared to H2-16.

Another key objective for LCG was to improve the branding, sales and marketing initiatives deployed by the Group and this has yielded positive results with new funded clients up 9% from H2-16, monthly client net deposits up 71% from H2-16 and overall assets under management (AUM) up 17% since H2-16.

The Group continued with its enhanced analysis of client trading activity and behaviour to ensure maximum revenue capture where opportunities allowed. As a result, revenues in the first 6 months of 2017 were 7% higher than the same period in 2016 despite the weaker trading conditions. Gross profit for the first 6 months of 2017 was 18% higher than the same period in 2016.

The improvements to technology and product offering as well the expanded market penetration to focus on markets outside LCG’s traditional UK offering, has resulted in greater revenue stability than in prior periods with monthly revenues of approximately £2m per month. This stability will ensure LCG is better equipped than in previous periods to withstand the challenging trading conditions that have been present in the first 6 months of this year.

Cost of sales for the period is £1.1m (2016 H1: £1.9m) and gross profit is £10.9m which represents a 91% gross profit margin on revenues (2016 H1: £9.2m gross profit and 82% gross profit margin). This increase in gross profit margin is the result of the increase in revenue capture the Group has seen since the introduction of the enhanced risk management analysis of client behaviour without any incremental increase in cost of sales.

EBITDA for the six month period is a loss of £0.9m (2016 H1: loss of £2.1m) and is approximately a 55% improvement on the same period last year. Administrative costs have stabilised at £12.7m for the period (2016 H1: £12.4m) and the Group expects to see further benefits of its cost reduction initiatives in the second half of the year.

The loss before tax was £1.8m (2016 H1: loss of £3.5m) and demonstrates the improvements the Group have made to ensure that, despite poor trading conditions seen in Q2-2016, there is a clear path of improvement and move toward sustainable long term profitability, through its improved branding, technology and investment in people.

The net cash and short term receivables, decreased 20% to £7.8m (2016:£9.7m) primarily as a result of the losses for the first half of 2017. Available liquidity which comprises own cash held, title transfer funds, unsegregated funds and amounts due from brokers decreased by £2.7m from 31 December 2016.