Following our earlier report about the Q1 profit warning it issued, Hong Kong Forex retail forex broker KVB Kunlun Financial Group Ltd (HKG:8077) has followed up by releasing its full first quarter 2017 results, indicating a major slowdown in business and a large net loss.

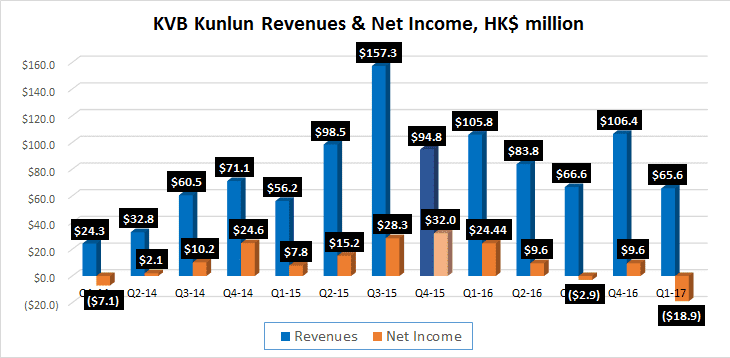

Overall, Revenues at KVB Kunlun came in at just HK$65.6 million (USD $8.4 million) in Q1, down 38% QoQ from Q4 – and KVB’s slowest quarter since Q1-2015.

And the sharp drop in Revenues hit the bottom line hard, with KVB posting a Net Loss of HK$18.9 million (USD $2.4 million) in Q1.

So what happened?

KVB management reported that they experienced a period of unfavorable trading conditions in Q1 due to reduced volatility in the foreign exchange and commodity markets. This resulted in the decrease in revenue. However, new client registrations and total clients’ trading volume increased during Q1, compared with that in the first quarter of 2016.

The company’s most-traded product during Q1 was Gold (XAU/USD), followed by EUR/USD, USD/JPY, USCRUDE and GBP/USD. In the first quarter of 2017, Gold traded within a fairly narrow price range of USD117 per ounce. Gold was traded at the highest price of USD1,263 per ounce and the lowest at USD1,146 per ounce. The price range of Gold was much narrower compared to the same period in 2016 (USD222 range).

The trading price range of crude oil was also narrower, with the highest at USD55.20 per barrel and the lowest at USD47 per barrel, compared with the highest at USD42.50 per barrel and the lowest at USD26.05 per barrel in the first quarter of 2016.

In the FX market, the price of the EUR/USD also traded in a much narrower price range in the first quarter of 2017, compared with the movements in the same period in 2016. The highest and the lowest level of the EUR/USD were 1.0905 and 1.0340 respectively, with a 565-pip trading range in the first quarter of 2017, compared to the movements of the price in first quarter of 2016 which represented a 700-pip trading range, from 1.1410 to 1.0710.

The unfavorable trading conditions, driven by low market volatility, has seen tighter profit margins earned from customer initiated trading volume.

Despite the slowdown in activity and revenues during Q1, KVB saw total expenses increase by 14% compared to the same period in 2016. Management attributed the increase mainly to:

1) increase in referral fees and other charges, mainly caused by increased commission rebate to external parties (including margin business and PRC operations);

2) increase in depreciation and amortization costs, mainly caused by new assets capitalization from late 2016;

3) increase in lease payments, mainly caused by the increased rental expenses of new Beijing office; and

4) increase in administrative expenses, mainly caused by increased marketing expenses, regulatory and compliance expenses, computer services expense and customer promotion expenses.

KVB’s full Q1 results report can be seen here (pdf).