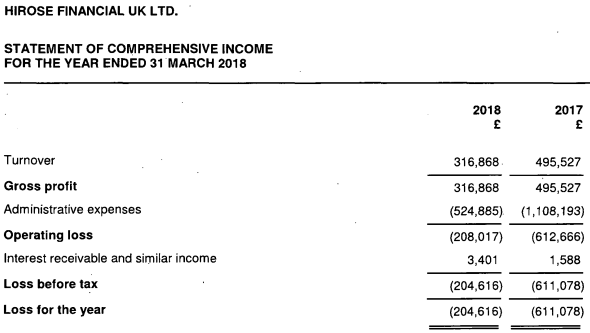

LeapRate Exclusive… LeapRate has learned via regulatory filings that Hirose Financial UK Ltd., the FCA regulated arm of Japanese retail forex brokerage group Hirose Tusyo Inc (TYO:7185), saw its Revenues tumble 36% in Fiscal 2018 (year ended March 31, 2018) to just £317,000, down from £496,000 last year. That follows a 47% revenue decline last year in Fiscal 2017.

Hirose UK also reported a net loss of £205,000 in Fiscal 2018, trimmed from a £611,000 loss in 2017, as the company cut expenses and staff.

The Hirose Group globally does about $200 billion in monthly trading volumes, making Hirose a mid-size Japanese broker. The parent company put an additional £700,000 of capital into the UK business during Fiscal 2018.

Hirose UK is licensed by the FCA as a matched principal broker. The company also used to be licensed separately by the UK Gambling Commission for its Binary Options product, but surrendered that license last year as the company exited the Binary Options business (more on that below).

However that bet didn’t seem to pay off for Hirose UK. The company subsequently dropped the Binary Options product, and as noted above surrendered its UK Gambling Commission license.

Instead, Hirose UK stated that it plans to seek more opportunities in the B2B market.

Hirose UK’s Fiscal 2018 income statement follows: