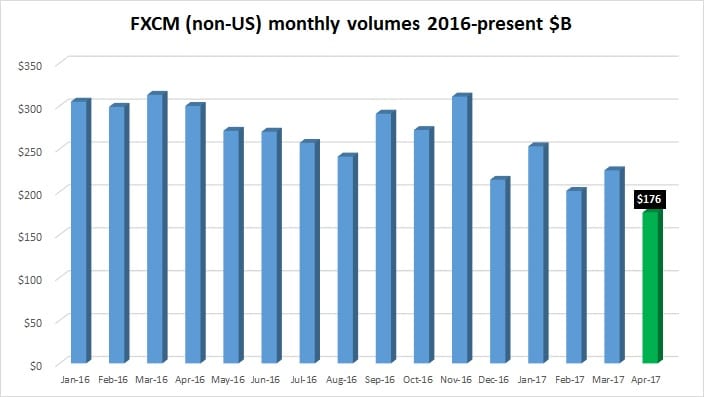

Retail forex broker FXCM Group LLC has announced that its trading volumes fell by 22% during April, to $176 billion.

The fall in volumes at FXCM, after a fairly strong March, were fairly in line with the volume decline we have seen in April from several other leading retail FX brokers.

The results of course represent trading volumes outside the US. FXCM sold its US clients to the Forex.com unit of rival Gain Capital Holdings Inc (NYSE:GCAP) in February, after the company and now ex-CEO Drew Niv were banned from the US forex market.

FXCM Group LLC (the operating company which reports the figures) is owned 50.1% by Global Brokerage Inc (NASDAQ:GLBR), formerly known as FXCM Inc, and 49.9% by Leucadia National Corp (NYSE:LUK).

FXCM’s full report on April customer trading metrics reads as follows:

FXCM Group Reports Monthly Metrics

NEW YORK, May 15, 2017 — FXCM Group, LLC (“FXCM Group” or “FXCM”), a leading international provider of online foreign exchange trading, CFD trading, spread betting and related services, today announced certain key customer trading metrics for April 2017 for its retail and institutional foreign exchange business.

April 2017 Customer Trading Metrics from Continuing Operations Customer Trading Metrics

- Customer trading volume of $176 billion in April 2017, 22% lower than March 2017 and 41% lower than April 2016.

- Average customer trading volume per day of $8.8 billion in April 2017, 10% lower than March 2017 and 38% lower than April 2016.

- An average of 347,500 client trades per day in April 2017, 10% lower than March 2017 and 34% lower than April 2016.

- Active accounts of 129,366 as of April 30, 2017, a decrease of 1,466, or 1%, from March 31, 2017, and a decrease of 3,669, or 3%, from April 30, 2016.

- Tradeable accounts of 108,883 as of April 30, 2017, a decrease of 197, or 0.2%, from March 31, 2017, and a decrease of 4,822, or 4%, from April 30, 2016.