Warsaw based X Trade Brokers Dom Maklerski SA (WSE:XTB), which operates Retail Forex broker XTB.com as well as the X Open Hub trading platform, has issued its full Q1 results report after earlier issuing a preliminary filing indicating that Q1 was a fairly slow one for the group.

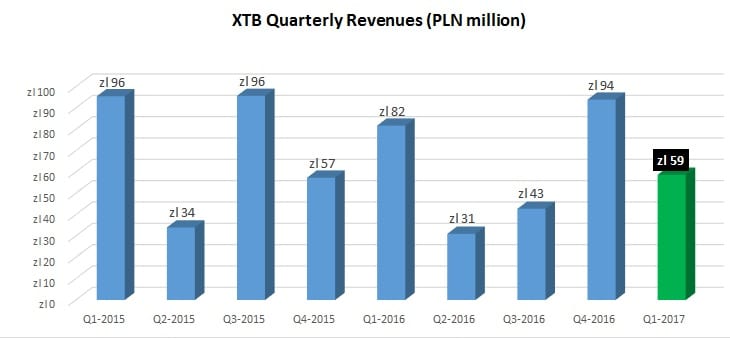

XTB continued its quite unusual pattern of up-and-down performance with a very slow quarter to begin 2017, confirming that revenues fell by 38% from Q4-2016’s record levels, coming in at PLN 58.7 million (USD $15.1 million) for the quarter.

The company gave no detailed explanation for the poor quarter, other than saying that the nature of the retail forex industry is very variable.

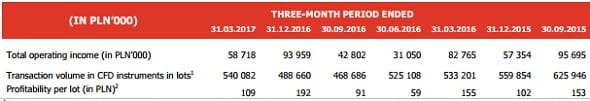

Interestingly, the drastically lower revenues came despite higher volumes for XTB – meaning that the real problem at XTB in Q1 was revenue-capture, or revenue-per-volume traded. That was an issue we noted at other Retail Forex brokers in Q1, including Gain Capital and its Forex.com brand. As per the table below, volumes at XTB were actually up 11% in Q1, while as noted revenues fell 38% from Q4.

Focus on Latin America – XTB noted that during Q1 it acquired a Belize-regulated brokerage called CFDs Prime Limited, paying PLN 837,000 ($217,000). The name of the company was then changed to XTB International Limited. XTB plans to use the Belize entity as a base for its operations in Latin America, naming Latin America a key target market for the broker going forward. XTB also established XTB Chile SpA during Q1.

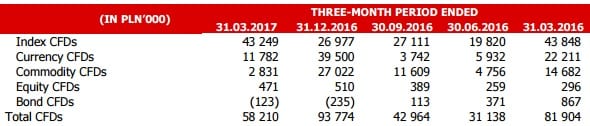

Drop in FX Revenues – Digging deeper in the filing, it appears as though the large fall in Revenues is attributable to a sharp drop from FX trading. Index CFDs accounted for nearly 75% of trading revenues at XTB in Q1, or PLN 43.2 million, while Spot FX trade related revenues fell from PLN 39.5 million in Q4 to just PLN 11.8 million in Q1.

Our analysis is that this does not reflect a drop in FX trading volumes, as discussed above, but rather indicates that the company acts as market maker without engaging in much outside hedging, especially in its FX business, making results highly volatile.

Problems in Turkey – XTB noted that a significant part of the group’s revenues during Q1 were transactions on instruments based on Turkish Lira. This was due to continued weakening of the currency to record levels, particularly in January of 2017, and a strong presence for XTB in the country. But that may change. On February 10, Turkish regulator CMB announced sweeping changes including a 10x limit on leverage and the introduction of a minimum deposit of TRY 50,000 (about $12,000).

The CMB’s changes may contribute to a significant long-term decrease in the number of XTB customers in Turkey, and to a significant reduction of activity of the XTB Group in Turkey. To date, no decisions regarding further XTB Group operations in the Turkish market have been made.

Management changes – XTB recently underwent a change in senior management. As was exclusively reported by LeapRate in early January, XTB decided to part ways with its CEO Jakub Maly after the company posted poor results in mid-2016, and saw its share price languish following the company’s IPO.

XTB went public on the Warsaw exchange last May at a valuation of about $350 million. However the company’s shares have drifted downward, trading now in the zl 7.30 range, off about 36% from their zl 11.50 IPO price. The company then confirmed Omar Arnaout as its new CEO in late March. Mr. Arnaout had been with the XTB group since 2007, starting as a Junior Dealer and working his way up the ranks since.

The management of XTB did not publish any forecasts of the results for 2017.

XTB’s full Q1 results report can be seen here (pdf).