LeapRate Exclusive… LeapRate has learned via regulatory filings made in the UK and Singapore that King & Shaxson Capital Limited has seen a significant drop in activity in Fiscal 2016. (The company has a June 30 year end).

King & Shaxson is the parent company of FCA regulated retail and institutional Forex broker PhillipCapital UK.

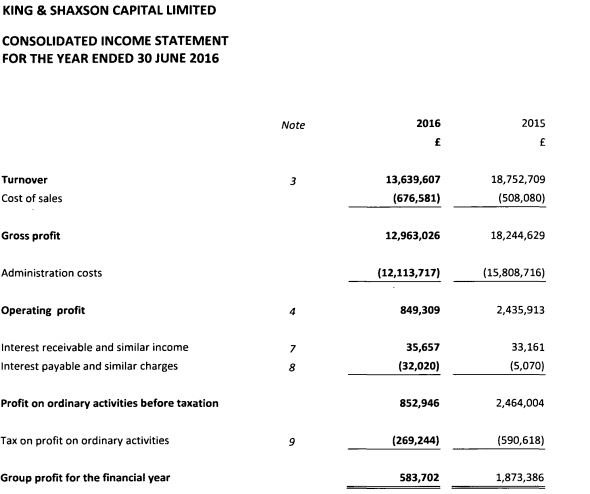

Overall, Revenues at K&S came in at £13.6 million in 2016, down from £18.8 million the previous year. The company did still turn a profit of £584,000 in 2016, down from £1.9 million in 2015.

King & Shaxson operates two key business units in the UK:

- a retail arm, doing mainly Forex and CFD business online and offline with retail clients under the PhillipCapital UK brand,

- an institutional arm, including a bond agency team and an interdealer broker.

We reported recently that the company had increased its investment in growing the retail FX and CFD business under the PhillipCapital UK brand. Last summer PhillipCapital UK launched a new website, designed with help from specialist firm Design by Structure. We discussed the company’s growth plans at the time in an interview with Sean Tan, Head of Derivatives at PhillipCapital UK and a 12 year veteran of the PhillipCapital Group.

Despite the poor results, the company did grow its funds under management, from £45.2 million in 2015 to £48.1 million as of year-end.

The company employs 68 people.

The King & Shaxson / PhillipCapital UK group has its roots in Singapore, and is ultimately controlled by Phillip Brokerage Pte in Singapore. Not surprisingly, the group is a leader in FX and CFD trading in Singapore, alongside UK-based brokers IG Group Holdings plc (LON:IGG) and CMC Markets Plc (LON:CMCX). However the results shown (income statement follows) are just for the UK arm.