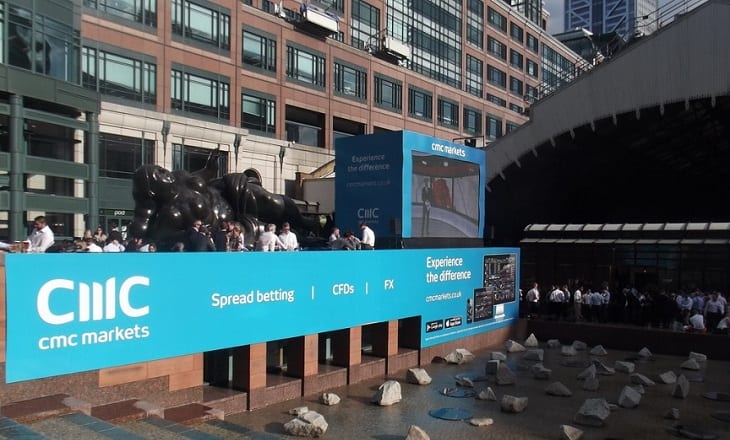

FCA regulated online CFD brokerage house CMC Markets Plc (LON:CMCX) has issued its H1 2018 Pre-Close Trading Update (for the six months to September 30, 2017 – CMC has a March 31 fiscal year end), which included what we view as mixed results.

The positive? CMC reported that profitability in H1 2018 is significantly higher than in the same period of Fiscal 2017. We’d note, however, that 1H-2017 was a very poor one for CMC, with Revenues and Profits significantly down from previous norms for the company.

The negative? CMC stated that the number of active CFD / Spreadbet clients for the period are slightly lower than H1 2017, with the excuse given being the short term interest seen around the EU referendum last year.

CMC announced a management reorganization earlier this year, with Grant Foley and David Fineberg assuming the newly created board roles of Chief Operating and Financial Officer, and Group Commercial Director, respectively, reporting to CEO Peter Cruddas. In these roles, Grant Foley will lead the Group’s corporate functions and David Fineberg will lead the Group’s commercial activities.

The full text of CMC’s trading update follows:

28 September 2017

CMC Markets Plc

H1 2018 Pre-Close Trading Update

CMC Markets Plc (“CMC”), a leading global provider of online retail trading, today issues the following Trading Update.

Profitability in H1 2018 is significantly higher than the same period in 2017 with both net operating income and revenue per client higher (and marginally higher than H2 2017), driven by increased client volumes. Active CFD / Spreadbet clients for the period are slightly lower than H1 2017 following the short term interest seen around the EU referendum. The strong increase in net operating income in H1 2018 despite the small decline in active clients reaffirms the firm’s continuing focus on high-value, experienced clients.

CMC retains its focus on cost discipline and operating costs before variable staff remuneration are broadly unchanged compared to the same period year-on-year. Costs in the second half are expected to increase through investment in key marketing initiatives, and the ongoing implementation of the Group’s stockbroking partnership with ANZ Bank in Australia, which remains on track for delivery next year.

Regulation remains a key focus for the firm, and despite profitability in H1 2018 being significantly higher than the same period in 2017, the firm remains cautious about the future outlook given the ongoing regulatory uncertainty and the impact, if any, potential changes could have on Group performance.

The results for the six months ending 30 September 2017 will be announced on Thursday 23 November 2017.