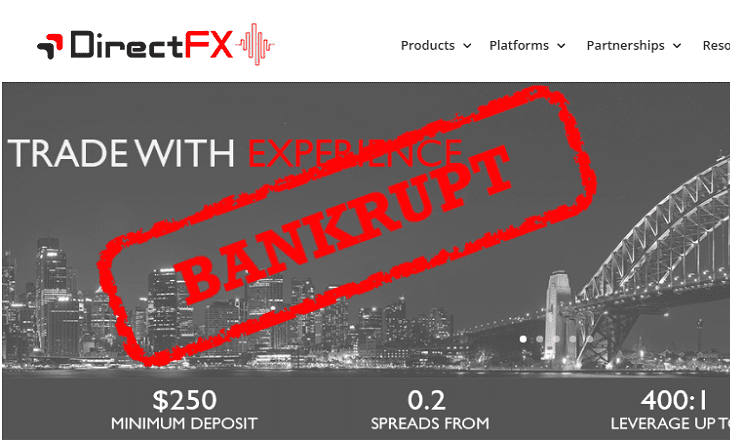

Following our exclusive report from Tuesday that Australian Retail Forex broker Direct FX was placed into liquidation with Deloitte named as administrator, it came as no surprise that today regulator ASIC announced that it was fully canceling Direct FX’s AFS license.

ASIC had first suspended Direct FX’s license back in April.

What was somewhat surprising, however, was that ASIC reported in its cancellation notice that Direct FX continued to carry on a financial services business while suspended, and continued to allow clients to enter into trades, which it was not supposed to do.

It is still unclear how much money was owed to Direct FX clients and other creditors, but there doesn’t appear that there’s much to distribute to them. ASIC stated that Direct FX had net tangible assets of less than AUD $750,000, one of the issues which ultimately led to the cancellation of its license.

ASIC also stated that the cancellation will affect the financial services provided by Direct FX’s authorised representative, Core Liquidity Markets Pty Ltd, to the extent that they are provided under authorisations granted under Direct FX’s licence.

Cathie Armour, ASIC

ASIC Commissioner Cathie Armour said:

Direct FX was in breach of multiple conditions of its AFS licence, which are aimed at protecting investors from the higher operational and credit risks posed by the retail OTC derivative sector. Direct FX ignored key conditions of the notice of suspension by continuing to open new trading positions and failed to comply with its client money reporting obligations whilst suspended. The ongoing and demonstrated disregard for meeting their obligations has resulted in ASIC acting to remove the company from the industry.