Just like Gold and Silver in the precious metals arena, Bitcoin and Ethereum have their own unique relationship in the crypto realm. It became apparent, however, in last week’s trading that the two cryptocurrencies can diverge, causing analysts to speculate on why such a divergence took place. How much of a divergence are we talking about? Ether bounced back from its losses with a 66% gain, although it has pulled back from its high of $148 and sits today around $125. Bitcoin managed a 25% gain in similar fashion.

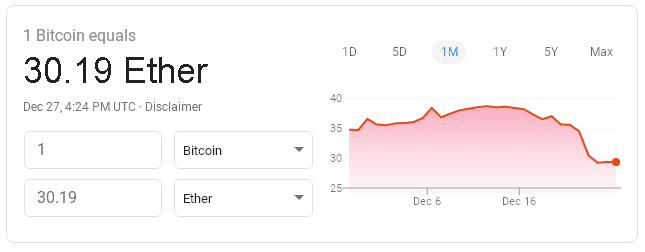

Bitcoin, the industry leader in market share with 53% of the overall market capitalization, is both a transaction currency at the point-of-sale, as well as an investment vehicle. Ether combines both of these characteristics with also being a development platform for smart contracts in the blockchain universe. This single difference can lead investors to favor ETH over BTC or the other way around on occasion. A simple 1-Month chart (Shown below) illustrates how this ratio between the two can change over time:

As can be seen, the ratio of BTC to ETH had hovered about 38, only to plunge down to 30. Why the significant change? Analysts are divided on the reasons why. First, the obvious platform differences could explain the shift.

According to one analyst:

Quite a substantial difference between the ETH and BTC structure. If you were betting on correlation remaining the same, and both reverting to structural equilibrium, $ETH seems to be the better play for shorts, and BTC for longs.

Both Bitcoin and Ethereum have lost nearly 80% of their market valuations in 2018, the reason why many traders that short for a living had most likely loaded up on Ether, as per the analyst’s above suggestion. If that were the case, then the broad-based recovery of all cryptos over December would have caused a brief, but decisive, short squeeze in favor of Ether coin holders (“hodlers”, if you wish to be true to crypto jargon).

Another analyst noted:

In the second half of December, Bitcoin, Ethereum, Bitcoin Cash, Ripple, and many crypto assets experienced relatively large gains against the U.S. dollar. $4,000 – $4,500 is major resistance [for Bitcoin] and we could stall out soon. It’s also possible this could go higher, but I do not think it goes much higher than $5,400, certainly not higher than $6,300.

As it turned out, BTC did hit $4,079, but has since pulled back to $3,746. Obviously, BTC did encounter substantial resistance at the $4,000 level.

Markets give and take away, but not always in equal portions, the lesson of the day. As for the opinion of Joseph Lubin, the co-founder of Ethereum, he recently said:

I am calling the crypto bottom of 2018. This bottom is marked by an epic amount of fear, uncertainty, and doubt from our friends in the 4th and crypto-5th estates.