The following article is based on research by Marshall Gittler, Head of Investment Research for FXPRIMUS.

FXPRIMUS Indicators and events for the week beginning 13 March: Fed, BoE, BoJ & SNB meeting; Dutch elections; Merkel/Trump meeting; G20 meeting

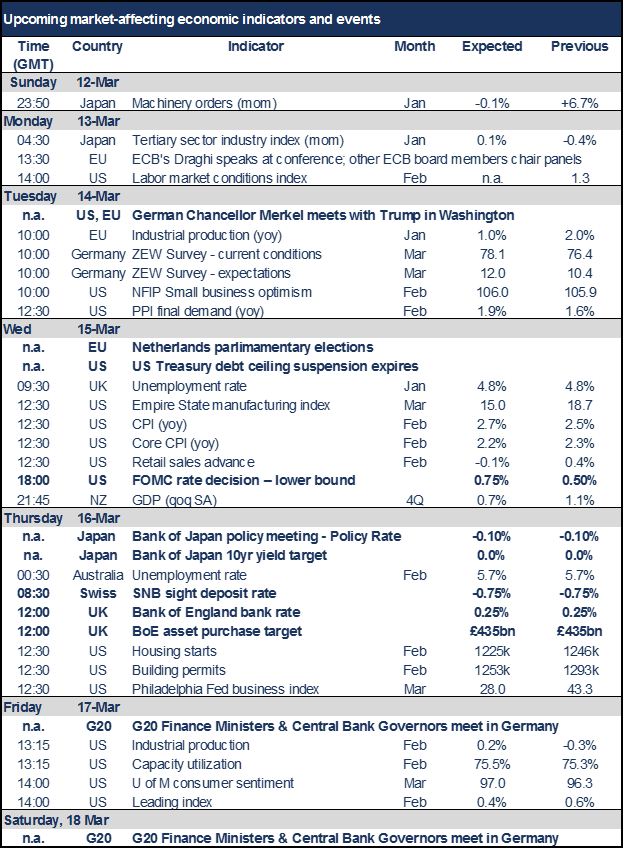

Usually the week after the nonfarm payrolls is relatively quiet, but this month we get no rest. There’s an unusual number of market-affecting events this week, including:

- Four central bank meetings (Fed, Bank of Japan, Swiss National Bank and Bank of England);

- Visit by German Chancellor Merkel to Washington;

- Dutch Parliamentary election, kicking off the European election season; and

- A G20 Finance ministers’ & Central Bank governors’ meeting over the weekend.

And to top it all off, the US hits up against the debt ceiling during the week too, although that won’t start to bite for another several months.

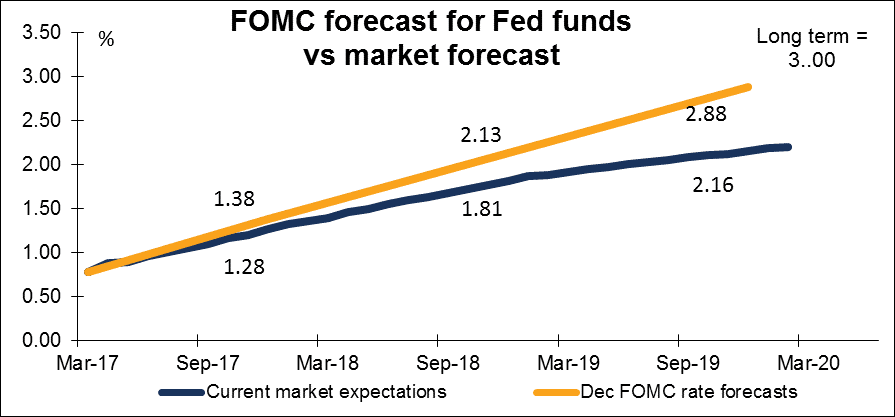

Central bank meetings

Of the four central bank meetings, only the US FOMC is expected to result in any changes. The big question isn’t what will happen to rates (they’re going up); people want to know what the FOMC members’ forecasts will be for where they think the fed funds rate will be at the end of the year (expressed in a graph known as the dot plot). In December, they expected three rate hikes each year for the next three years; will they change that to four this year or next? A steeper path for Fed funds could be dollar-supportive.

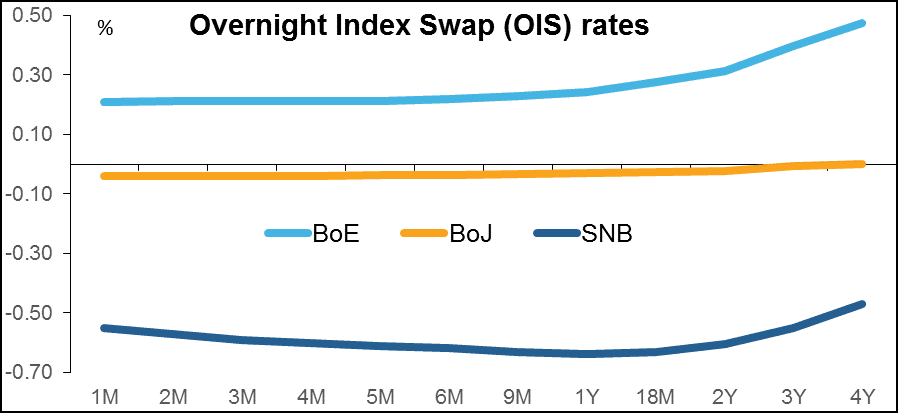

The Bank of England, Bank of Japan (BoJ) and Swiss National Bank (SNB) on the other hand aren’t expected to make any changes in their monetary stance. Investors don’t expect Britain to hike rates for another two years, the SNB isn’t likely to move until the ECB does (Jan. 2019 according to market rates) and the BoJ…well, Japanese rates have been close to zero since 1999, so nobody looks for much change any time soon (although they could change their target for 10-year yields).

Trump and Merkel are expected to discuss a wide range of issues, including the global economy, trade, NATO, the fight against the Islamic State, and ties with Russia and China. So far his meetings with other heads of government have ended with everyone happy, but there are more areas of conflict between the US and Germany. This meeting could result in US criticism of Germany’s trade position, which could be positive for the euro.

The Dutch elections are considered an indication of how the more important French elections next month might go. The key point is how Geer Wilder’s euroskeptic PVV Party does. The better he does, the more voters in France may think of voting for the National Front. That could increase fears about the future of the euro.

Friday and Saturday, the G20 Finance Ministers and central bank governors, including the new US Treasury Secretary, gather in Germany to discuss the world outlook. Normally these meetings aren’t market-affecting, but this time, the draft communique reportedly has some big changes: they’ve removed the pledge to refrain from “competitive devaluations” and reintroduced a reference to “excessive global imbalances.” That could imply a green light for US intervention to weaken the dollar to rectify the trade deficit.

On top of that busy schedule, there are a large number of important indicators. These include:

- US: Empire State & Philly Fed indices, CPI, retail sales, housing starts & permits, industrial production, and U of M consumer confidence

- EU: Industrial production, German ZEW survey, trade balance

- UK: labor market data

- Australia: Business & consumer confidence, labor market data

- NZ: Q4 GDP