The following article was written by Jens Chrzanowski, Regional German Director at FCA regulated broker Admiral Markets UK.

Hello,

Jens Chrzanowski, Admiral Markets

If you’re an avid reader of LeapRate and other trading portal articles on a daily-basis (like me), you may have noticed that every week seems to bring news of yet another national regulator intent on introducing even stricter trading regulations. Often the central theme of such ‘thinking out loud’ is leverage and how to limit the level that’s available to traders. The constant spotlight on this topic seems to imply that leverage is evil, or a generally bad thing. So, would it actually be better to not use leverage while trading?

The Prohibition, which began nearly 100 years ago, was a constitutional ban on the production, importation and sale of alcoholic beverages in the United States. There’s a lot of very good evidence to suggest that people should avoid drinking alcohol, during the 1920s and early 1930s the US government vehemently followed this advice. Prohibition supporters, known as ‘Drys’, saw this as a victory for “public morals” and health…

Was it a good idea? Well, is the ban still imposed? No. Society’s opinion changed over time.

The purpose of this historic example is to help understand my view of leverage. We should, of course, treat alcohol with great care. Children should never be allowed near it and the golden rule of “don’t drink and drive” should always be followed. This is just common sense. But is it common sense to also totally ban adults from drinking wine or beer… Definitely not!

Just as with alcohol, leveraged trading is not suitable for everyone. Simple risk warnings stating this can be found on every regulated European broker’s webpages. They can be found everywhere: in their advertising, on their homepage, during the account opening process, etc. It’s almost impossible not to notice these warnings, which is how it should be. But if something is “not suitable for everybody” it means that it IS still suitable for some!

If you have a smaller account, a higher leverage of maybe 200 or 500 could make sense, allowing you to make smaller trades. If you have a bigger account, a leverage of “just” 50 may be more appropriate. For scalping, holding a position just for seconds or minutes, I can only imagine the kinds of interesting trades that could happen with a higher leverage!

If you’re the kind of trader who gets scared by losing just 5 percent in a single day, leveraged trading is not for you.

The alternative to leverage trading is to use a ‘safe’ savings account, where, depending on your country, you can get maybe 1 per cent interest per year. In Germany, my home country, the usual interest rate for a saving account is around 0,01 per cent, per year! This can hardly be classed as a ‘Rock n’ Roll’ investment!. But, it is safe, at least you won’t lose money. This is your choice. With leveraged products you could make this amount in seconds – or lose it… with interest. As always, the opportunity goes hand in hand with the risk.

So, will a heavily regulated, strict limitation of leverage end up like the US Prohibition and not last long at all?

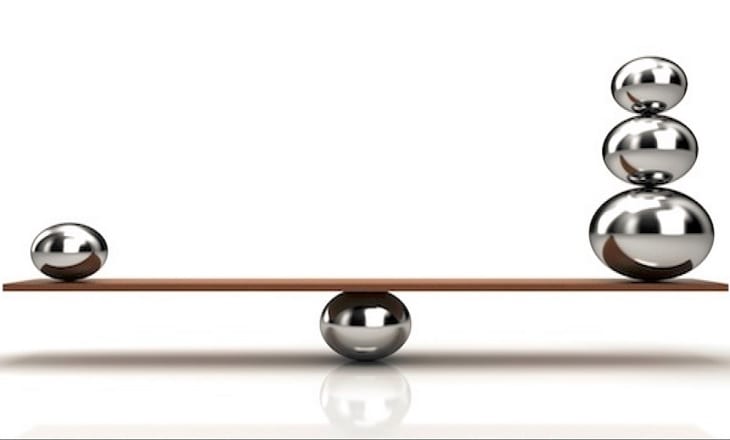

We at Admiral Markets believe in and even encourage good regulation. But, and here’s the key, it has to be regulation which acts with sound judgement, one that strikes the perfect balance between personal freedom and protection. For an experienced daytrader or scalper, a maximum available leverage of 10 or 50 doesn’t make sense. If he faces these conditions, he may decide to simply abandon regulated brokers and find an offshore broker who will offer him “anything”. Is this the best solution for our industry? I don’t think so.

National regulators are not competitors, but they do offer very different opinions on the concept of leverage. For example, the German regulator, BaFin, proposed a 100% Negative Balance Protection on any CFD offered in Germany. But BaFin don’t see that a limitation of available leverages makes more sense, because different traders should be able to use different trading strategies. This is freedom. Other national regulators believe that a maximum leverage of 20 or 25 (or even less) should be offered.

Nobody is able to say what the ‘right’ way is, because people are different, we are all unique. But in general, we all believe in personal freedom. So, let’s think, in which world would we like to live… in a world of US prohibition, or in a world which has found the right balance between freedom and protection.

Leveraged trading is not evil. It’s neither good nor bad, it’s not that simple. Actually, it’s the same as drinking alcohol… Use it wisely!

See you next week.

Do you have feedback, concerns, requests, maybe even compliments? I’d love to hear. Please contact me via: [email protected].

Trading on margin carries a high level of risk, and this article should not be seen as advice or solicitation to buy or sell, but written for informational purposes.