It has been another positive weekend for Bitcoin trading.

But this time, it seems as though there was some method to the madness.

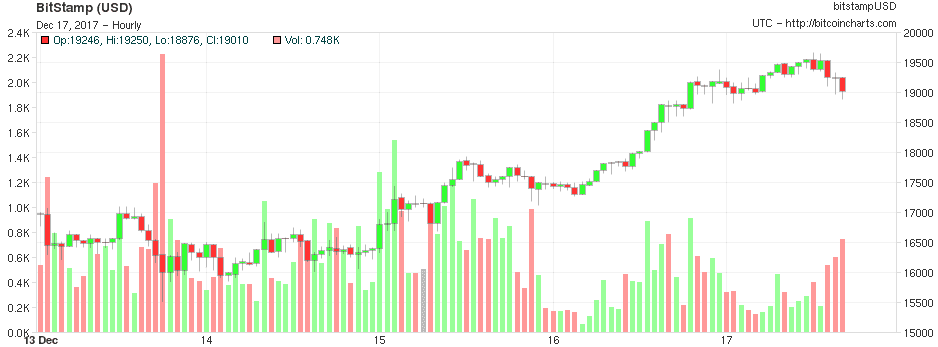

After spending most of Friday trading in the $16,000-$17,000 range – up from the $13,000 range just last weekend – Bitcoin prices rose throughout the weekend and spent most of Sunday bouncing between $19,000 and just-under-$20,000.

It is still less than a month that Bitcoin first crossed the $10,000 barrier.

The 10% weekend rise comes just ahead of the launch of Bitcoin futures trading at CME Group Inc (NASDAQ:CME), the world’s largest operator of derivatives exchanges. CME announced in late October the planned launch of Bitcoin futures – allowing crypto investors a regulated offering that will provide transparency, price discovery, and risk transfer capabilities. After setting Monday, December 18 as its launch date, the CME was lapped by rival CBOE, which went live with its Bitcoin futures trading offering last week.

It remains to be seen if futures trading venues will bring more institutional and “smart” money into the Bitcoin trading craze, which has been dominated to date by Retail traders, mainly from the Far East. But either way, Bitcoin bulls do seem emboldened that the launch of futures at places such as CBOE and CME are another step in “institutionalizing” Bitcoin, pulling it away from the realm of “fad” and into the list of real “establishment” currencies which are here to stay.

As of Sunday evening 17:00 GMT, Bitcoin was trading hands on various exchanges at just above $19,000.

Bitcoin price chart past five days. Source: Bitcoincharts.com.