After seamlessly blasting through the $10,000 mark and setting an all-time high of $11,395 early last week, Bitcoin prices came back down to earth and leveled out at just above $9,000 on Thursday and Friday, beginning what looked to be a possibly uncertain December for the ever-popular cryptocurrency.

But not to worry. Once again, it has been the weekend to the rescue.

As we have written several times before, there is a clear phenomenon of very active retail trading in Bitcoin during weekends, much of it from the Far East (read: China), a time when many retail traders actually have some time to themselves and their own pursuits.

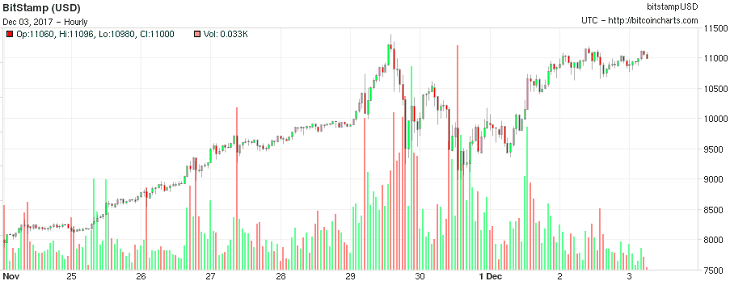

Yes, this weekend has been no different. As Europeans are just beginning to stir early Sunday morning, they will wake to Bitcoin prices once again above not just $10,000 but also $11,000, with Bitcoin threatening that all-time high once again. As of the time of writing, Bitcoin was changing hands at $11,060, based on data from Bitstamp.

Bitcoin price chart past 10 days. Source: Bitstamp.net.

This weekend, however, there is also a good fundamental reason for the rise – the continued mainstreaming of Bitcoin. Late Friday, Bitcoin got a vote of confidence from two respected names in the electronic trading world, Gain Capital Holdings Inc (NYSE:GCAP) and CME Group Inc (NASDAQ:CME).

Gain Capital, one of the original names in online FX trading and still today one of the largest Retail FX brokers, said just before the weekend that it would be launching Bitcoin trading at its FCA regulated City Index UK unit, with plans to also bring Bitcoin trading to clients of its global FOREX.com brand in the coming months. Key to Gain Capital’s announcement was the implication that it is now satisfied that there exists proper access to reliable Bitcoin liquidity, an implication that was not lost on traders.

And, derivatives exchange operator CME Group confirmed that it would launch cash settled Bitcoin Futures trading later this month. Again, another important milestone in the “mainstreaming” of Bitcoin, bringing it away from the online shadows and closer to the comfort level of institutional traders.

Which brings up another important point.

Most if not virtually all Bitcoin trading to date has been “retail” trading, with much larger institutional entities absent from the market – a fact that in part explains the super-volatility of Bitcoin prices. However institutional types are clearly eyeing crypto thanks to Bitcoin’s meteoric rise. From just a demand-supply perspective, there is a lot of “dry powder” out there in the form of institutional money which might (and is even likely) to enter the Bitcoin stage at some point. And moves by respected entities such as Gain Capital and the CME which deal with institutional traders are bringing them even closer.

Food for thought, on another Bitcoin weekend….