Binary options platform and brokerage group TechFinancials Inc (LON:TECH) has issued its Trading Update for the first six months of 2017 and, not unexpectedly, did not contain much good news.

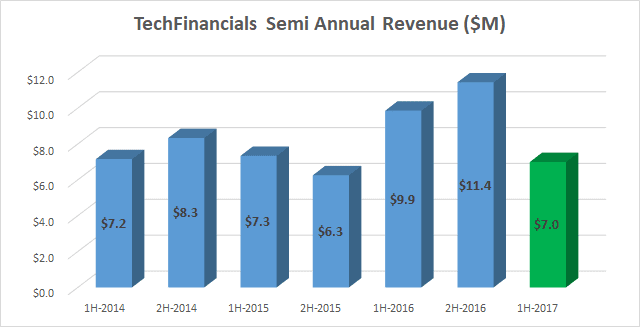

As the binary options sector has been hit hard both by regulators worldwide, including TechFinancials’ home country of Israel, and by a lot of negative press and publicity, TechFinancials reported that Revenues for the first six months of 2017 will come in at about $7 million – 39% below the $11.4 million TechFinancials brought in in the second half of 2016.

On the bottom line the company stated that it lost money, but that its EBITDA loss will be no greater than $0.4 million. The company had cash of $5.8 million as at June 30, 2017.

TechFinancials admitted, as was exclusively reported by LeapRate last week, that it has been actively downsizing in Israel and relocating jobs to the Ukraine.

The company didn’t break down the ‘damage’ between its B2B platform and B2C brokerage divisions, but did state that it is focusing on bolstering the B2C business. In Asia, TechFinancials is shifting its focus from Binary Options to Forex and CFD products. In Europe, the company is increasing its activity through BO Tradefinancials, its CySEC regulated subsidiary that operates the OptionFair trading platform. As we exclusively reported when TechFinancials last reported results for 2H-2016, activity at OptionFair had dropped significantly late last year, to the point of almost drying up altogether.

Management of TechFinancials also stated that they would all be taking a 20% pay cut.

The statement issued by TechFinancials reads as follows:

4 July 2017

TechFinancials Inc. (“TechFinancials” or the “Company” or the “Group”)

Pre-Close Trading Update

TechFinancials Inc. (AIM: TECH), a leading provider of financial trading solutions for retail customers, provides an update on trading ahead of its half-year results for the six months ended 30 June 2017, which is expected to be announced in August 2017.

The Group expects revenues to be in the region of $7.0 million and expects an EBITDA loss of no greater than $0.4 million. The Group had cash of $5.8 million as at 30 June 2017.

As previously reported, the global regulatory environment related to Binary Options remains challenging, which has had an adverse impact on the business and trading. As a result, the Board has taken a number of decisions to mitigate the regulatory impact and to restructure the business and reduce its operational costs. The Company is constantly seeking to diversify its product offering and is actively looking at different potential projects that will leverage the Company’s technology and its expertise in online financial trading solutions.

The Board is reducing the Company’s headcount in Israel and Asia and is moving some positions to Ukraine where employment costs are lower. Additionally, all Board and senior management team members have taken a 20% salary reduction.

The Group is focusing on bolstering the B2C business. In Asia, the Company is shifting its focus from Binary Options to Forex and CFD products. In Europe, the Group is increasing its activity through BO Tradefinancials (“BOT”), its regulated subsidiary that operates the OptionFair trading platform, and it hopes that it will soon be able to announce further developments in that division.

In light of the increased regulatory environment the outlook for the Group remains challenging for the foreseeable future. Notwithstanding the regulatory headwinds, the Group’s net cash position of $5.8 million is strong and the Board feels confident it is well positioned to meet these challenges. The Board will continue to keep tight controls of all overheads and will update shareholders of the Company’s progress when it announces its Interim Results.