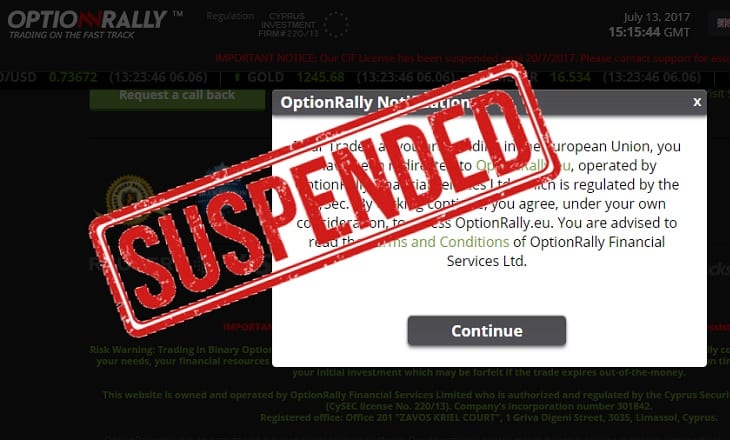

Cyprus financial regulator CySEC has announced the suspension of the CIF license granted to Binary Options broker Optionrally Financial Services Ltd.

The reasons given by CySEC involve issues involving protection of clients’ funds, the company’s own funds, and the company’s capital adequacy ratio.

CySEC has given OptionRally one week to take actions in order to comply. In the interim, OptionRally Cannot take on any new clients, cannot execute orders, cannot advertise itself as investment services provider, and must mention on all of its websites that its CIF licence has been suspended.

We’d note that this seems to be CySEC toughening its stance on brokers found non-compliant. In the past, CySEC usually gave brokers 30 days to “sort things out”.

We’d also note that this is the second recent loss by OptionRally of a brokerage license. As we reported in early May, OptionRally lost its Belize IFSC license. The company has operated two separate websites, optionrally.eu for the CySEC regulated entity and optionrally.com under the Belize IFSC regime.

The full release on the matter by CySEC follows:

13 July 2017

CYSEC Decision

CySEC Decision date: 13.07.2017

Regarding: OptionRally Financial Services Ltd

Legislation: The Investment Services and Activities and Regulated Markets Law

Subject: Suspension of CIF licence

The Cyprus Securities and Exchange Commission (‘CySEC’) announces that the authorisation of the Cyprus Investment Firm OptionRally Financial Services Ltd (‘the Company’), number 220/13, is suspended, pursuant to section 26(2) of the Investment Services and Activities and Regulated Markets Law of 2007, as in force (‘the Law’), as there are suspicions of an alleged violation of:

1. section 28(1) of the Law, due to the Company’s possible non compliance, at all times, with all the authorisation and operating conditions in Part III of the Law and more specifically with section 18(2)(j) of the Law (protection of clients’ funds),

2. section 67 of the Law (own funds), and

3. Article 92(1) of the European Regulation (EU) 575/2013 (capital adequacy ratio).

Within one (1) week, the Company has to take actions in order to comply with the aforementioned provisions.

While the suspension of the CIF authorisation is in force, the Company:

1. Cannot enter into a business relationship with any person and take upon any new client.

2. Cannot receive, transmit or execute any orders from clients for buying any financial instruments.

3. Cannot provide/perform any investment services in Cyprus or outside Cyprus (in member states and third countries).

4. Cannot advertise itself as investment services provider and should mention on all of its websites that its CIF licence has been suspended.

5. Must, if existing clients so wish, without being considered in violation of section 26(5) of the Law:

- 5.1. Close all open positions in relation to clients’ contracts, or of its own, on their maturity date or on an earlier date if the client so wishes.

- 5.2. Return to existing clients all of their funds and profits earned.