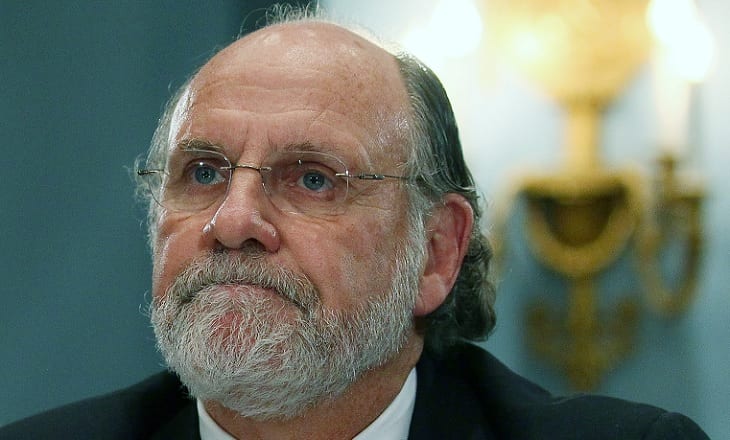

The U.S. Commodity Futures Trading Commission (CFTC) has announced that it has obtained a federal court Consent Order against Jon Corzine, former CEO of MF Global, requiring him to pay a $5 million civil monetary penalty for his role in MF Global’s unlawful use of customer funds totaling nearly one billion dollars, and for his failure to diligently supervise the handling of customer funds.

As part of the Order, Corzine cannot seek or accept, directly or indirectly, reimbursement or indemnification from any insurance policy with regard to the penalty amount.

The Order also requires Corzine to undertake that he will never act as a principal, agent, officer, director, or employee of a Futures Commission Merchant (FCM) and that he will never register with the CFTC in any capacity.

Prior to becoming CEO of the now-bankrupt MF Global in 2010, Jon Corzine had been a United States Senator from New Jersey from 2001 to 2006 and was the 54th Governor of New Jersey from 2006 to 2010.

The court also imposed a $500,000 penalty and registration and employment restrictions against Edith O’Brien, MF Global’s former Assistant Treasurer, for aiding and abetting MF Global’s unlawful use of customer funds. The Order prevents Ms. O’Brien from associating with an FCM or registering with the CFTC in any capacity for a period of 18 months.

Previously, the CFTC obtained Orders against MF Global and its parent company MF Global Holdings Ltd. (Holdings), which required restitution in amounts sufficient to pay all customer claims against the bankrupt company.

Aitan Goelman, the CFTC’s Enforcement Director, stated:

This resolution demonstrates the importance that the Commission attaches to customer protection, which has long been a hallmark of our mission.

The Orders arise out of the CFTC’s amended Complaint, filed on December 6, 2013. The Corzine Order finds that Corzine was the CEO of MF Global from September 1, 2010 through the commencement of its liquidation proceedings on October 31, 2011 as well as the CEO and Chairman of the Board of Directors of its parent company Holdings. The O’Brien Order finds that she supervised MF Global’s Treasury Department, which handled the cash management of MF Global, and was responsible for directing, approving, and/or causing certain wire transfers and other payments into and out of MF Global’s customer accounts. Both Orders find that, during the last week of October 2011, in violation of U.S. commodity laws, MF Global unlawfully used nearly one billion dollars of customer segregated funds to support its own proprietary operations and the operations of its affiliates and to pay broker-dealer securities customers and pay FCM customers for withdrawals of secured customer funds.

The Orders find that MF Global violated the Commodity Exchange Act (CEA) and CFTC Regulations by failing to treat, deal with, and account for its FCM customers’ segregated funds as belonging to such customers; failing to account separately for, properly segregate, and treat its FCM customers’ segregated funds as belonging to such customers; commingling its FCM customers’ segregated funds with the funds of any other person; using its FCM customers’ segregated funds to fund the operations of MF Global and its affiliates, thereby using or permitting the use of the funds of one futures customer for the benefit of a person other than such futures customer; and withdrawing from its FCM customer segregated funds beyond MF Global’s actual interest therein.

When the transfers occurred, Corzine controlled MF Global, which was experiencing a worsening liquidity crisis. Because of this control and by his conduct, Corzine is liable for MF Global’s violations as its controlling person. Furthermore, from at least August 2011 through October 31, 2011, Corzine failed to supervise diligently the activities of the officers, employees, and agents of MF Global in their handling of customer funds. By this conduct, Corzine violated CFTC Regulation 166.3, 17 C.F.R. § 166.3.

The O’Brien Order finds that O’Brien, knowing that certain funds would be transferred from customer segregated accounts to MF Global’s proprietary accounts, on Thursday, October 27, 2011 and Friday, October 28, 2011, directed, approved, and/or caused seven transfers of funds from customer segregated accounts to MF Global’s proprietary accounts totaling hundreds of millions of dollars – more than MF Global had in excess segregated funds as last reported to O’Brien – that caused and/or contributed to a deficiency in the customer segregated accounts. By this conduct, O’Brien aided and abetted MF Global’s segregation violations.

The CFTC previously settled charges against MF Global and its parent Holdings for their violations of the CEA and CFTC Regulations (see CFTC Press Releases 6776-13 [November 18, 2013] and 7095-14 [December 24, 2014]). On November 8, 2013, the CFTC obtained a federal Consent Order against MF Global for misuse of customer funds and related supervisory failures in violation of the CEA and CFTC Regulations (see CFTC Press Release 6776-13, November 18, 2013). MF Global was required to pay $1.212 billion in restitution to its customers, as well as a $100 million civil monetary penalty. On December 23, 2014, the CFTC obtained a federal court Consent Order against Holdings also requiring it to pay $1.212 billion in restitution, joint and several with MF Global, and imposed a $100 million penalty (see CFTC Order and Press Release 7095-14, December 24, 2014).

Pursuant to these Orders against MF Global and Holdings, restitution has been paid to satisfy all customer claims.